Visakhapatnam is the second-largest city in the state of Andhra Pradesh. It is home to many state-owned heavy industries and steel plants. Nestled in the port city on the southeast coast of India, it is also known as “The Jewel of the East Coast.” To maintain the city's charm, the authorities apply GVMC property tax on all the properties in the location.

In its governance of the city of Visakhapatnam, the Andhra Pradesh region's civic needs are managed by the Greater Visakhapatnam Municipal Corporation (GVMC). Greater Visakhapatnam Municipal Corporation was formed to meet the demands concerning the city's infrastructure development.

This makes GVMC a major administrative head in support of business relocation in the city as it cooperates with local property owners to collect taxes necessary to develop local services and infrastructure. Property tax GVMC, also known as house tax or municipal tax, is levied on building inhabitants to provide and maintain facilities such as roads, sewerage, parks, and street lights.

What is GVMC Property Tax?

GVMC property tax is the annual tax imposed on Greater Visakhapatnam Municipal Corporation region property. It manages basic amenities and services that are of help to citizens. The levying of property taxes is however controlled by parameters such as the type of properties owned, the purpose for which the property is put, or its location. Thus it makes sure every owner does his fair share of maintaining the society.

The property tax fund can be used for basic activities like:

- Development of the City

- Construction of new roads

- Ensuring cleanliness

- Availability of better facilities by the local government

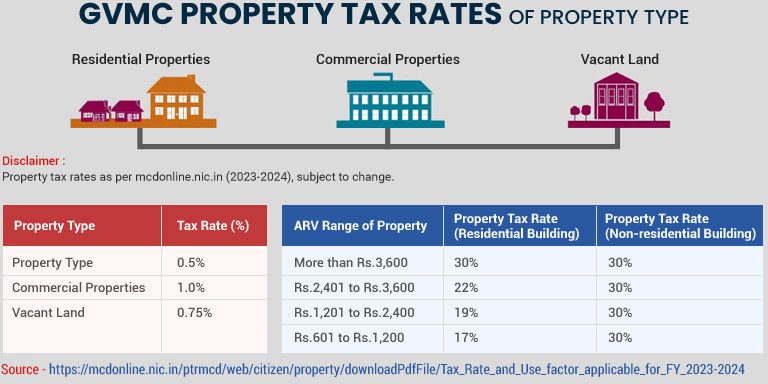

GVMC Property Tax Rates According to Property Types

More of a known fact is that every property comes with a different tax rate. Tax rates can differ from residential properties to commercial ones. Accurate information about the applicable tax rate can help owners make easy calculations.

| Property Type |

Tax Rate (%) |

| Residential Properties |

0.5% |

| Commercial Properties |

1.0% |

| Vacant Land |

0.75% |

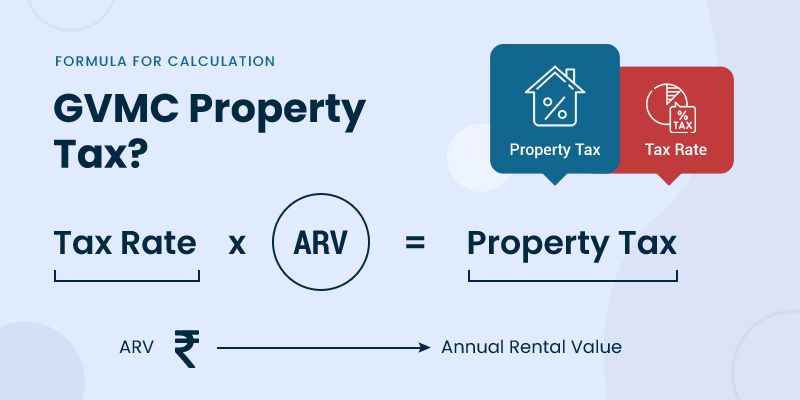

How to Calculate GVMC Property Tax?

To calculate the GVMC property tax you must be aware of the Annual Rental Value (ARV) and applicable tax rate of the property. The formula to calculate the property tax is:

Property Tax = ARV x Tax Rate

Let’s understand this better with an example

- ARV of the Residential Property= 10,000

- Applicable Tax Rate 0.5%

Property Tax Calculation

- Property Tax = 10,000 x 0.005= 50

- So, the tax applicable will be of 50Rs.

It is very important to remember that the property tax can differ following various factors including property size, types, and location within the Visakhapatnam. You can also use the Online Tax Calculator to calculate the tax.

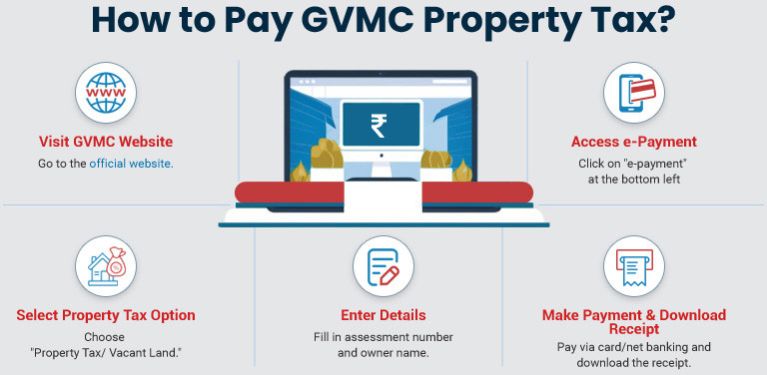

How to Pay GVMC Property Tax?

GVMC tax payment process can be done through both online and offline tax payment modes. Depending on your convenience you can choose and pay any of the below-mentioned methods.

Steps for GVMC Property Tax Online Payment

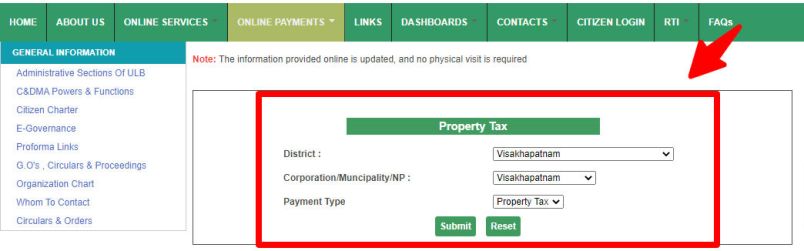

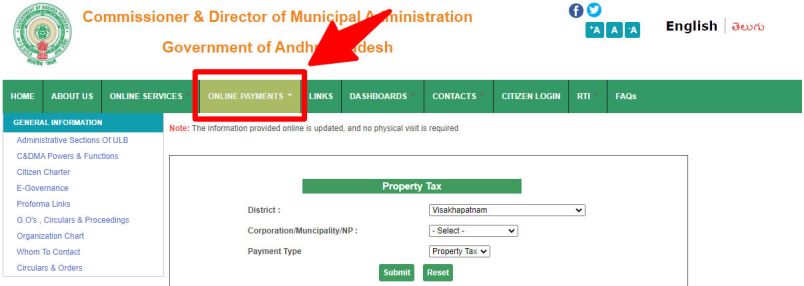

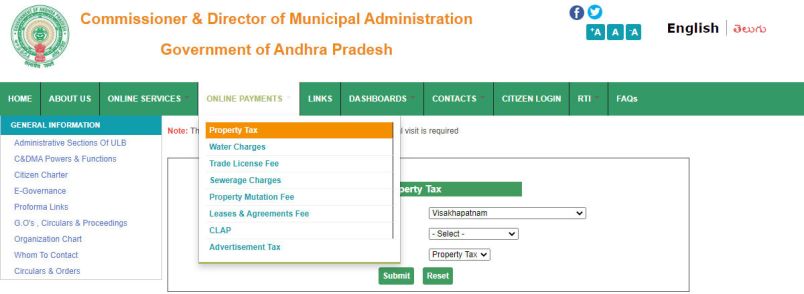

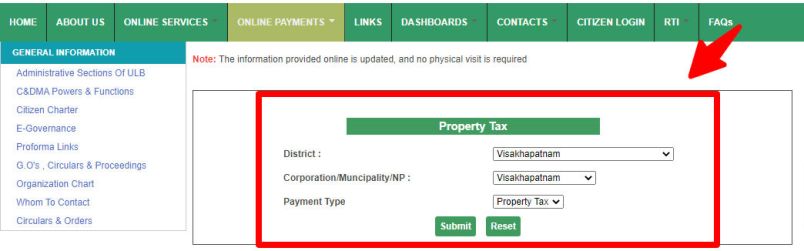

Similar to NNVNS Property Tax and BBMP Property Tax, GVMC has also bought the online payment mode into the system. Now taxpayers can pay taxes from the comfort of their homes by leveraging the online portal. Here are the steps for the GVMC property tax pay online process:

- Open the official website of GVMC

- Click on the online payment option in the 4th tab.

- In the sub-menu, select the option of “Property Tax/ Vacant Land.”

- Fill the necessary details like - District, Corporation/Muncipality/NP, and Payment Type and then click on submit.

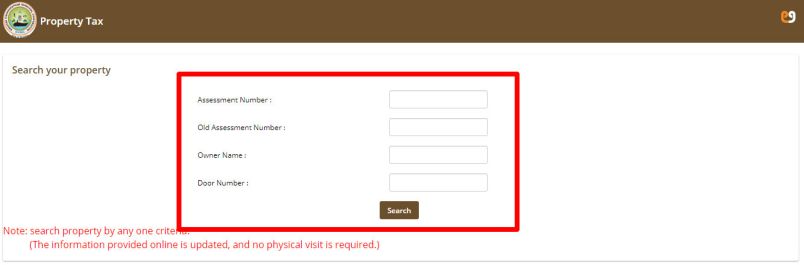

- Fill in the required details like assessment number, owner name and Door Number.

- After submitting the details you will be able to see the due payments

- You can complete the payment using a debit card, credit card, or net banking

- After successful payment, download the GVMC property tax receipt

Steps for GVMC Property Tax Offline Payment

Online mode may or may not be convenient for everyone. So, taxpayers can also make offline payments for GVMC property tax. For proceeding with the offline payment of property tax you can look at the steps below:

- To make the offline payment you can visit the nearby Purva Seva Centre

- You can look out for the designated authority member for offline GVMC tax payment

- Once connected with the agent, you can share all the important details of your property including Zone, District, Corporation, and utility.

- To complete the process submit all the required details including the property assessment slip and the unique number of the property.

- Pay the GVMC property tax with Cash, Credit, or Debit cards.

- The designated authority will share the valid property tax receipt.

Steps to Pay GVMC Property Tax Through Mobile App

You can also make the payment for your property tax using the mobile application. To do so you can follow these steps:

- Install the Purva App on your smartphones.

- Open the application.

- Fill in all the details including the unique number of the property, district, and zone.

- Select the mode of payment .

- After completing the GVMC property tax payment you can download the receipt.

How to Obtain GVMC Property Tax Receipt?

Maintaining records of all tax payments is a crucial obligation for every taxpayer. Make a copy or save the GVMC property tax receipt every time you make the payment. Obtaining the receipt can even help make future payments without any challenges. It also acts as a prove of successful tax payments.

If you have paid the tax but can’t find the receipt, then you can follow the steps down below:

- Visit the official website of GVMC

- Click on the option labeled “Know Your Recept.

- After clicking on the option, a new page will appear on the screen.

- Select the right options for the property. The options include the Zone, name of the district, corporation, municipality, etc.

- Click on the “Submit” button

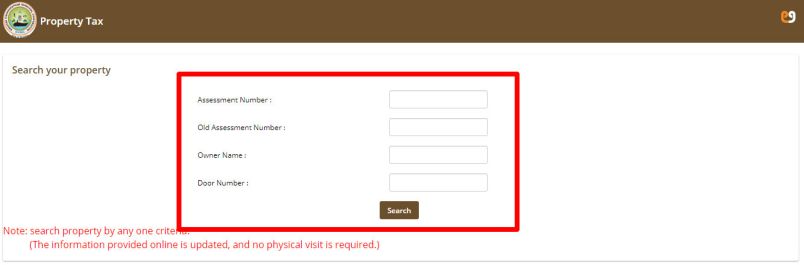

- Now click on the “Search Your Property” option

- Fill in the right details in the boxes appearing on your screen.

- Again click on the “Search” button.

- You will be able to see the details of your property on the screen. Cross-check the details and proceed with the GVMC property tax receipt download.

- Download the receipt and print it for any future references.

Exemptions and Concessions for GVMC Property Tax

Local authorities like GVMC never miss a chance to appreciate early taxpayers. GVMC tax system allows a 5% rebate to the owners if the payment is made before 30th April of each financial year. This rebate system helps in creating awareness for timely tax payments.

Ahead of the rebate system is the concession system in GVMC property tax. Concessions are deductions or relaxations on tax amounts depending on the ARV of the property. The concession structure for GVMC follows:

- 10% deduction from ARV if the property is 25 years or less old

- 20% dedication from ARV if the property is 25-40 years old

- 40% dedication from ARV is for properties older than 40 years

How to File GVMC Property Tax Alteration?

The local authorities understand the need for application modification. Therefore it permits you to edit or alter the tax application. The website allows you multiple options including name change, and conversion of Vacant Land Tax (VLT) to House Tax (HT)

For proceeding with the alteration of the property tax application look at these steps:

- Visit the website at - https://cdma.ap.gov.in/

- Click on the option “Online Services” in the menu bar

- Then click on the option “Property Tax.

- Click on the option stating “File your Addition/ Alteration.

- Provide your information about the district and municipality

- Now fill in the assessment number on the new window.

- You can start by filling in the required details to request a change.

Zones of Greater Visakhapatnam Municipal Corporation

For administrative purposes, the Greater Visakhapatnam Municipal Corporation (GVMC) has been subdivided into eight sub zones. Each zone attends to the local needs and development within its jurisdiction.

Here is the list of zones:

| Zone 1: |

Madhurawada |

| Zone 2: |

Asilmetta |

| Zone 3: |

Suryabagh |

| Zone 4: |

Gnanapuram |

| Zone 5: |

Gajuwaka |

| Zone 6: |

Vepagunta |

| Zone Bheemunipatnam |

Bheemunipatnam |

| Zone Anakapalle |

Anakapalle |

Taxes on property are levied and governed within every zone but the rates and regulations are inconsistent and not uniform across the zones.

Conclusion

Timely GVMC property tax payments are essential for the local infrastructure and services that add value to the quality of life for residents in Visakhapatnam. Online services can be used for making payments, which not only facilitates compliance but also ensures that municipal governance is effective. Residents are urged to seek information about their obligations and the availability of online resources that can make managing their property taxes easier.

Frequently Asked Question on GVMC Property Tax

Q: What is GVMC property tax, and how is it used?

Ans: A tax levied by the Greater Visakhapatnam Municipal Corporation on every type of property is called GVMC property tax. This tax is used for infrastructural development and maintenance.

Q: What happens if I miss paying my GVMC property tax?

Ans: In case the taxpayer has missed paying GVMC property tax, then a 2% penalty is levied.

Q: What is ARV?

Ans: ARV stands for Annual Rental Value. ARV is one of the factors used to calculate the property tax.

Q: Is it possible to use the Pura Seva mobile application to pay the GVMC property tax online?

Ans: Yes, you can use the Pura Seva mobile application to pay the GVMC property tax online.

Q: When is the last date to pay my GVMC property tax?

Ans: The last day for the GVMC payment is 30th April of each financial year.

Q: Is there any penalty for not paying GVMC Property Tax in Visakhapatnam?

Ans: Yes, there is a penalty of 2% for not paying the property tax GVMC timely. It can also lead to serious legal actions.

ADD COMMENT