Paying property tax sometimes feels like a chore, but we can't forget the reality of these property tax payments. It’s the contribution towards the development of any city or region. Earlier in December 2016 the Kolkata Municipal Corporation (Amendment) Bill was passed to make the KMC property tax assessment and calculation process easier.

So if you are a property owner in Kolkata or are planning to buy a new property then, understanding KMC property tax is more than a necessity. Let’s break down every single aspect of Kolkata Municipal Corporation Property tax. From the calculation method to tax rates and then payment modes, you will find everything here!

What is KMC or Kolkata Property Tax?

The tax levied on all types of property in Kolkata is termed as Kolkata Property Tax. The supervision of Property Tax in Kolkata is under Kolkata Municipal Corporation. Back in the year 2016, the bill for KMC property tax was passed. To make the calculation easier and effective, local authorities implemented the UAA system which became effective on 1 April 2017

How to Calculate KMC Property Tax?

Ensuring to make the payment for property tax is an important task but what's more important is to understand the calculation method. Unlike the NNVNS property tax and GVMC property tax, the property tax system of Kolkata follows the Unit Area Assessment System (UAA).

Calculating the KMC property tax rate following the Annual Rental Value (ARV) was the traditional method. However, the Unit Area Assessment System simplifies the tax calculation by using a special formula that incorporates all the factors.

KMC Property Tax: Unite Area Assessment System (UAA)

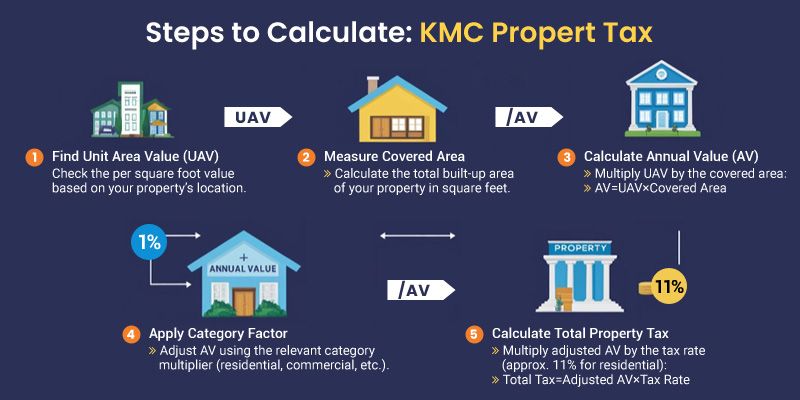

Every taxpayer can easily complete property tax calculations following the UAA system if they consider the below-mentioned points:

- Under UAA guidelines, the authority has divided the whole Kolata region into major 293 blocks. Further, these blocks are sub-categorized into 7 zones that range from A to G. The division is made on factors like Infrastructure, Value of Property, Amenities nearby, and development.

- Multiplicative Factors: The factors are based on specific characteristics including the age of property, structure type, and status of occupancy.

- Another important aspect to note is that different houses in the same grade have different tax rates. The concept of multiplicative factors can be utilized in the calculation of the exact tax rate.

- The calculation is done by calculating the Base Unit Area Value (BUAV). BUAV refers to the annual value per square feet. Among all the categories the most high value is for category A, and the lowest BUAV value is for category G.

- All the slum areas protected under West Bengal premises fall in the G range. These areas have lower tax rates.

- The colonies or ~residential properties in Kolkata~~ that come under the Government’s BSUP and EWS schemes fall under category E. These are also known as RR and Refugee Rehabilitation.

- Base Unit Area Value (BUAV): The KMC property tax rate calculation follows per sq. ft based on the location of the property.

After understanding all the concepts and points of UAA, let's further understand the method of calculation of KMC property tax.

Kolkata Property Tax: Base Unit Area for Tax Rate

| Category of Block |

BUAV per sq. ft (in Rs) |

| A |

74 |

| B |

56 |

| C |

42 |

| D |

32 |

| E |

24 |

| F |

18 |

| G |

13 |

Steps for calculation of Multiplicative Factors?

| Property Location (Road Width) |

MF |

| ≤ 2.5m |

0.6 |

| >2.5 m but ≤ 3.5 m |

0.8 |

| >3.5 m but ≤ 12 m |

1 |

| >12 m |

1.2 |

Property Tax Kolkata: Building Age Factors

| Age of Building |

MF |

| More than 20 years |

1 |

| Less than 20 years but more than 50 years |

0.9 |

| Less than 50 years |

0.8 |

Kokata Muncipal Corporation: Occupancy Factors

| Occupancy Status |

MF |

| Non-residential property under tenancy ≤ 20 years |

4 |

| Residential property with a tenant, tenancy ≤ 20 years |

1.5 |

| Garage/parking space/fee |

4 |

| Property occupied by a tenant for 20-50 years |

1.2 |

| Property occupied by a tenant for 20-50 years, with tenancy rights protected under West Bengal regulations |

1 |

| Long-standing tenant in residence |

1 |

| Family-owned and occupied |

1 |

KMC Portal Property Tax: Building Usage

| Usage of Building |

MF |

| For Residential Use |

1 |

| Waterbody |

0.5 |

| Healthcare, institutions, theatre, hotel < 3-star, Bar |

3 |

| Industrial/Manufacturing, Small Shop (<250 sq. ft.), Restaurant |

2 |

| 3-star and 4-star hotels, ceremonial house |

4 |

| Shopping and entertainment complex |

6 |

| Office, bank, and luxury hotel accommodations |

5 |

| Nightclub, remote ATM, skyscraper, billboard |

7 |

| Vacant land up to 5 kottah excluding those categorized above |

2 |

| Vacant land above 5 kottah |

8 |

KMC Property Tax Online: Building Structure

| Structure of Building |

MF |

| Residential building, plot > 10 kottah |

1.5 |

| Residential property currently rented, with a lease term of 20 years or less |

1.5 |

| IG’s Special projects, covering space of more than 2000 sq. ft |

1.5 |

| Pucca Properties |

1 |

| Open, covered, and garage parking available |

0.8 |

| Semi Pucca |

0.6 |

| Common Area |

0.5 |

| Kutcha |

0.5 |

Tax Variation according to the type of property

| Type of Property |

Tax Rate (%) |

| Undeveloped Slums |

6 |

| Developed Slums |

8 |

| Properties of Government under KMC Act, 1980 |

10 |

| Properties with Annual Value Less than Rs 30,000 |

15 |

| Others |

20 |

Property Tax Kolkata calculation formula considering all the above factors and tax rates

Annual tax = BUAV x Covered space/Land area x Location MF value x Usage MF value x Age MF value x Structure MF value x Occupancy MF value x Rate of tax (including HB tax)

Note: HB Tax in the above calculation format refers to the Howrah Bridge tax. All the properties near Howrah Bridge as expected to pay this tax rate accordingly.

Let's understand the calculation with a quick example -

Calculation of Property Tax West Bengal With Example

Example Inputs: -

- BUAV (Base Unit Annual Value): ₹50,000

- Covered Space: 1,500 sq. ft.

- Land Area: 2,000 sq. ft.

- Location MF Value: 1.2 (multiplier for location quality)

- Usage MF Value: 1.0 (multiplier for residential use)

- Age MF Value: 0.9 (multiplier for age of the property)

- Structure MF Value: 1.1 (multiplier for structure type)

- Occupancy MF Value: 1.0 (multiplier for full occupancy)

- Rate of Tax: 5% (0.05 as a decimal)

Steps of tax calculation

- Covered Space Ratio Calculation:

- Land Area/Covered Space = 1500/2000 =0.75

- Substitute Values into the Formula:

- Annual Rate=50,000×0.75×1.2×1.0×0.9×1.1×1.0×0.05

- Calculate Step-by-Step:

- 50,000×0.75=37,500

- 50,000×0.75=37,500

- 37,500×1.2=45,000

- 37,500×1.2=45,000

- 45,000×1.0=45,000

- 45,000×1.0=45,000

- 45,000×0.9=40,500

- 45,000×0.9=40,500

- 40,500×1.1=44,550

- 40,500×1.1=44,550

- 44,550×1.0=44,550To

- 44,550×1.0=44,550

- 44,550×0.05=2,227.50

- 44,550×0.05=2,227.50

Final Result of Kmc property tax calculation

The annual tax calculated based on the given inputs is:

Annual Tax amount =₹2,227.50

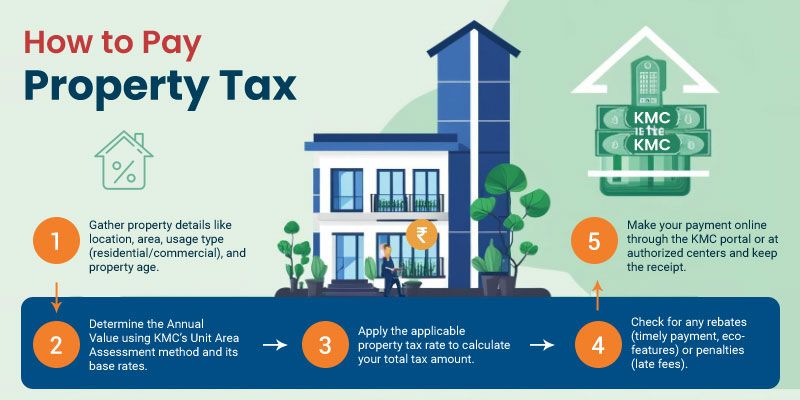

What Are The Steps To Pay KMC Property Tax?

Every owner or property buyer must pay property tax on time in Kolkata. In line with the payment process, the local authorities of Kolkata have built KMC property tax online payment portal to make the process easier and smoother.

Now taxpayers can either pay online or offline depending on their choice and convenience.

Below are the steps for both the online & offline payment modes:

How to Pay KMC Property Tax Online?

To pay kmc property tax online you can adhere to the steps jotted down below:

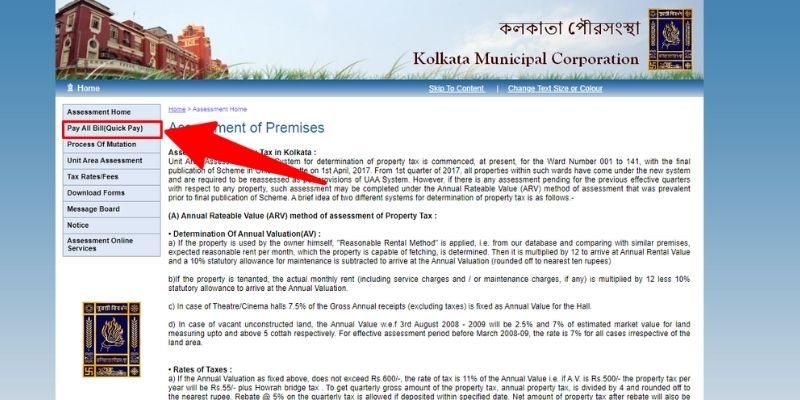

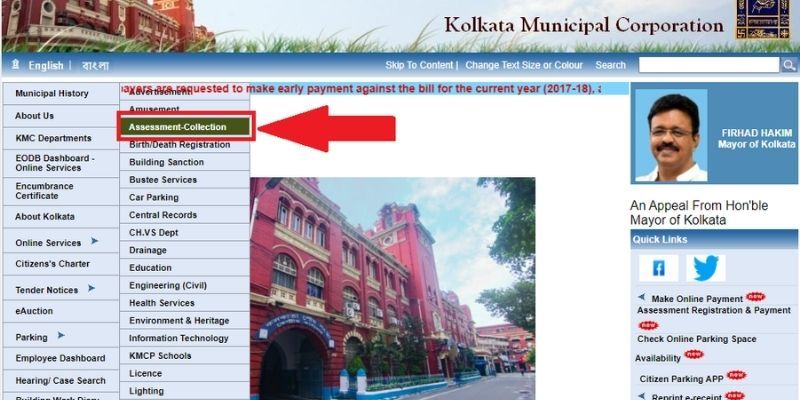

- Access the official website of Kolkata Municipal Corporation at https://www.kmcgov.in/KMCPortal/HomeAction.do

- On the left sidebar menu of the portal, there is an option for "Online Service."

- Hover over the option and select "Assessment-Collection"

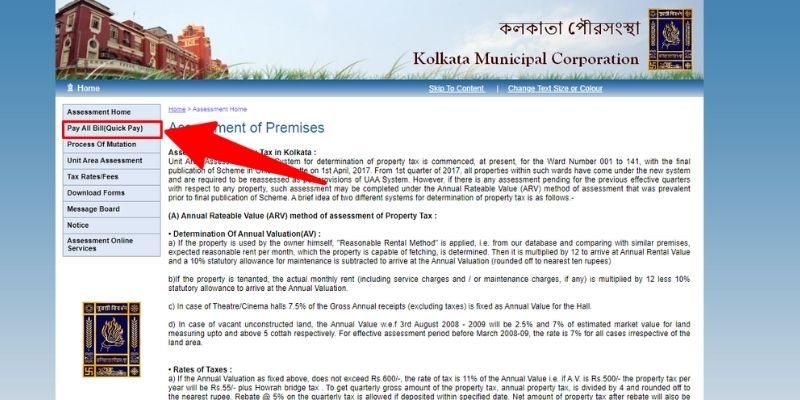

- From the dropdown options click on "Pay All Bill (quick pay)"

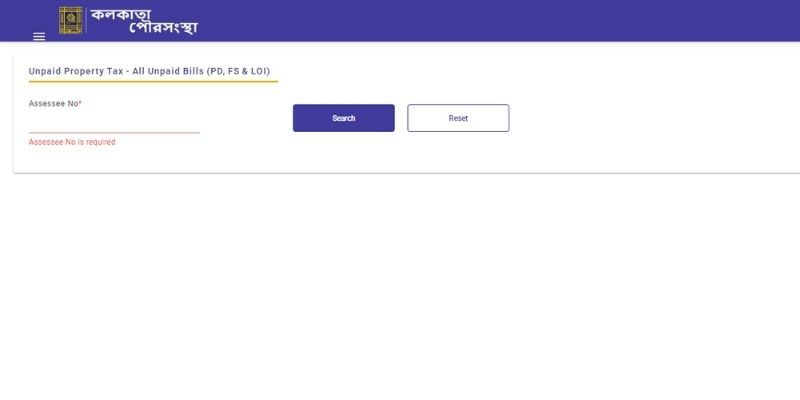

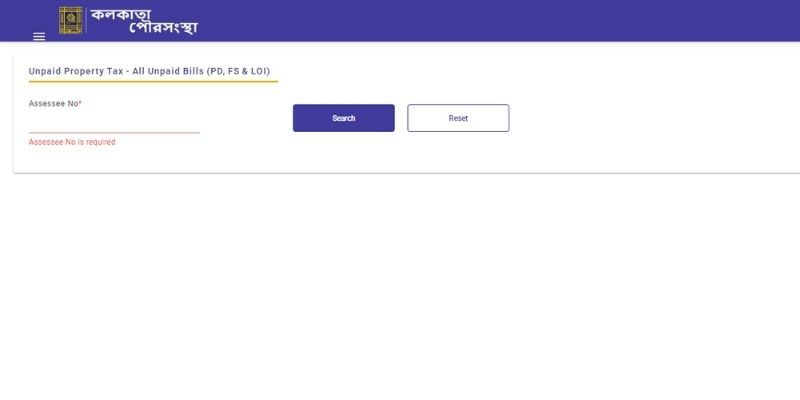

- Fill in your Assessee number to check how much tax is due

- Click on the "Search" button

- Now proceed with the payment option

- Pay the property tax online via credit card, debit card, net banking and UPI ID.

- Once successfully made the payment of property tax, generate the tax receipt

- Download the tax receipt and save it for future

How to Pay KMC Property Tax Offline?

To proceed with the Kmc property tax payment through offline mode you can follow these steps:

- To make the payment for property tax bills offline visit the nearby municipal corporation

- At the inquiry desk ask for the tax application form

- Fill all the necessary details in the application form

- Re-check the details

- Submit the details to the designated kmc official personnel

- Pay Kolkata property tax usingthe desired payment option

- Obtain the receipt from the authority for the payment made by you

How Can I Check My Tax Staus Online in Kolkata?

It's important to learn how to pay tax, but more of it you must know the steps to check the status of the payments made by you. Here are the steps you can practice to check the status:

- Visit the official kmc website

- Click on the option "Assessment Registration and Payment"

- Click on "Continue

- Fill in your mobile number and captcha to log in

- Now fill in your property details

- Click on "Check Payment Status

- You will be able to see your payment status

Kolkata Corporation Property Tax Waiver Scheme

Beginning in 2025 from 1 April, property tax obligations will adopt a graded waiver scheme:

- Above 10 Years: 35% interest and 25% penalty waiver.

- 5 to 10 Years: 40% interest and 50% penalty waiver.

- 2 to 5 Years: 45% interest and 75% penalty waiver.

- Under 2 Years: 50% interest and 99% penalty waiver

Kolkata Property Tax Online Payment Rebate

To get a 6% rebate on the applicable tax you can pay your kolkata property tax online. This will help you reduce the tax rate applicable

Property Tax Receipt for Kolkata Municipal Corporation Properties

To generate the receipt for property tax payment start by:

- Visiting the KMC official website

- Ensure the tax is paid, click the option "Online Services"

- Select 'Assessment Collection'

- Choose 'Reprint E-Receipt'

- Select the start and end date

- Click 'Search' to download the receipt

Conclusion

Depending on the property age and other factors, any payee can proceed with the property tax calculation formula. Moreover, it's quite important to pay property tax and make the city develop in every aspect. A timely payment not only saves you from legal actions but ensures the development of the city you live in.

Frequently Asked Question on KMC Property Tax

Q: Are there any rebates or exemptions available for property tax payments in Kolkata?

Ans: Kolkata Property Tax offers a 6% early payment rebate and a 1% rebate for all online payments. In addition, there are significant penalty waiver schemes.

Q: Are there different property tax rates for commercial properties in Kolkata?

Ans: Yes, the property tax applicable on commercial properties is comparatively higher than the one for residential properties.

Q: What are the property tax rates for residential properties in Kolkata?

Ans: The residential property tax in Kolkata depends on various factors. However, approximately it ranges from 9% to 40%.

Q: How can property owners stay informed about changes in property tax rates or regulations in Kolkata?

Ans: The official KMC website can help you stay informed about all the updates and changes in the property tax valuation. You can also visit the nearby authority to check the updates

Q: What happens if property tax is not paid in Kolkata?

Ans: In case of non-payment of property tax in Kolkata, you may face legal action. Penalty charges are also applicable.

Q: Is property tax paid every year in Kolkata?

Ans: Yes, property tax is levied on the buyer or owner annually. Owners can even make payments semi-annually at their convenience.

ADD COMMENT