Planning to accommodate your property in Varanasi? Then you must clear out all your confusion regarding house tax Varanasi. No matter whether it is for personal use or commercial, tax is applicable on all sorts of property. The funds from this tax contribute towards the developmental project in the city.

Varanasi Nagar Nigam takes control of the tax management in Varanasi. To understand more about the house tax system in Varanasi you can quickly read the guide below. It includes all important details along with the steps for how to pay property tax in Varanasi, the computation method, exemptions, and much more.

What is House Tax in Varanasi?

Annual tax applied on the property defines the term Varanasi House tax. Determination of the tax amount depends on the rental or market value. The payment of Nagar Nigam house tax Varanasi funds the Basic improvements of the city. The tax levied on properties differs from property to property. Commercial properties have higher tax rates in comparison to the ones used for residential purposes.

Why is it Important to Pay Varanasi House Tax?

Since the NNVNS house tax funds are allocated to the local government, it brings glory to the city as it is used for:

- Construction of new roads

- Ensuring better sanitation through the zones

- Maintaining proper water supply for the residents

- Establishment of street lights wherever needed

So paying house tax in Varanasi will add to the beauty and glory of the spiritual streets. It will enhance the lifestyle of residents and attract more tourism.

What is Commercial House Tax in Varanasi?

Commercial house tax is the tax imposed on properties utilized for performing any commercial activities. Properties for building a shopping complex will incur the tax rate as per the commercial house tax policy.

What is the Residential House Tax in Varanasi?

There are many people out there looking to settle in Varanasi and are exploring flats for sale in Varanasi. In these property-buying scenarios, the buyer has to pay the tax rate. The tax rates are as per the residential house tax system.

What is the House Tax Rates in Varanasi in 2024?

The current house tax rate in Varanasi in 2024 depends on the Annual Rental Value (ARV) of properties. The property tax rate in Varanasi includes both the house tax and the water tax.

Here is a brief description of the municipal tax rate in Varanasi

As per the official website of NNVNS org in house tax the total property tax rate of 23.5% compromises:

- House Tax- 13.5%

- Water Tax- 10%

An 11% tax rate is set for the properties with an annual valuation up to ?50,000

| Property Sorting |

Annual Rental Value (ARV) Increase |

Property Tax Calculation |

| Existing Buildings with Increased Rent |

10% to 25% of Previous ARV |

ARV x 23.5% |

| Monthly Rental Existing Building |

Monthly Rent x 10 |

ARV x 23.5% |

| New Building |

(Building Value + Land Value) / 20 |

ARV x 23.5% |

Note: Varanasi Property Tax rates are revised after every three years. The previous AVR witnesses an increase of 10-25% for determining the new ARV.

House Tax Calculation for Varanasi Properties

The Nagar Nigam Varanasi House tax calculation methods are different for rented properties and newly constructed ones.

- To calculate house tax for rented properties you can follow this method:

- Annual Rental Value (ARV)= Monthly Rent x 10

- The house tax calculation in Varanasi for newly constructed buildings follows:

- Annual Rental Value (ARV) = Building Value + Land Value/ 20

- For calculating the annual property tax rate:

Factors to consider while calculating Varanasi Property Tax

There are several factors to consider while proceeding with the house tax calculation in Varanasi. The list of factors includes

- Floor size or Built-up Area

Without finding the total area or square meter of the property it is not possible to calculate the tax. The Nagar Nigam Varanasi house tax process requires the appropriate measurement of the land in square meters.

Thinking that every new and old building comes with the same tax rate can be your mistake. Following the house tax policy in Varanasi older buildings receive some concession in their gross annual valuation.

| 10 years |

25% reduction |

| 11-20 years |

32.5% reduction |

| More than 20 years |

40% reduction |

Both the commercial and residential property have different tax rates. Commercial properties have more ARV and thus the tax rate is high in comparison to residential properties.

The ARV Calculation is influenced by several factors including the location of the property, area, and the zone it resides in. The NNVNS house tax system holds the authority to set the value. It can vary depending on the locations and zones.

House tax Calculation

To understand the calculator better let's take an example of a residential property of 1,200 sq. ft. The first and most important step is to examine the applicable tax rate based on the table above.

- Property Size- 1,200

- ARV= Rs 50,000

House tax calculation in Varanasi

Property Tax= 50,000 x 23.5/ 100

=50,000×0.235

=11,750

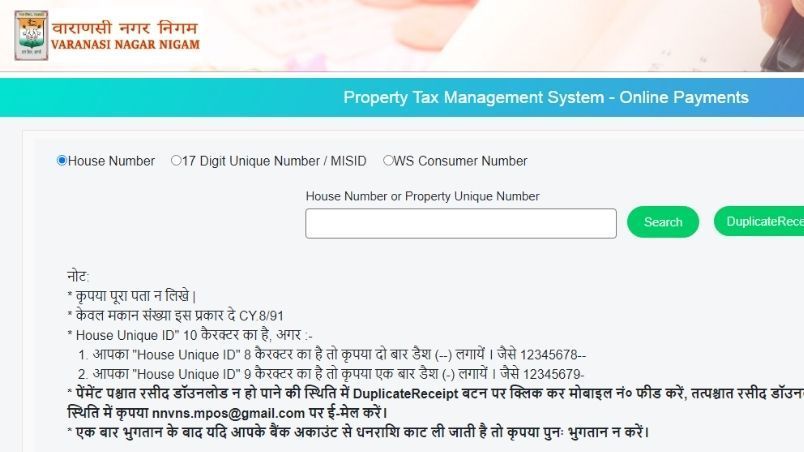

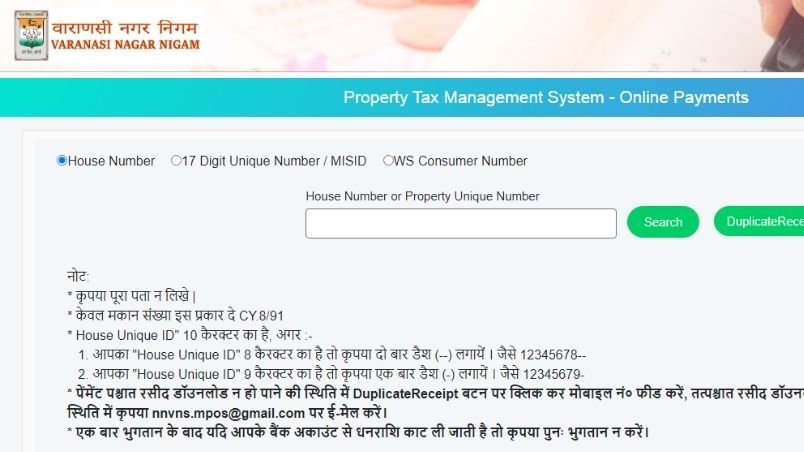

What are the steps to check house tax online in Varanasi?

To proceed with the house tax check Varanasi procedure continue with the steps jotted down below:

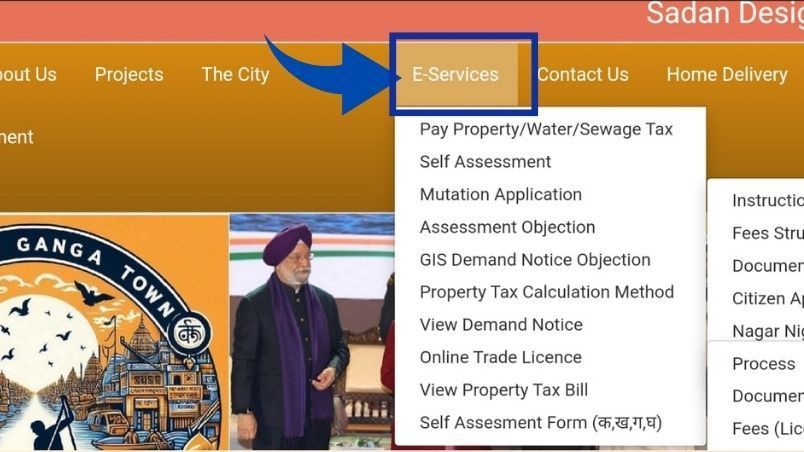

- Access the Nagar Nigam’s official website

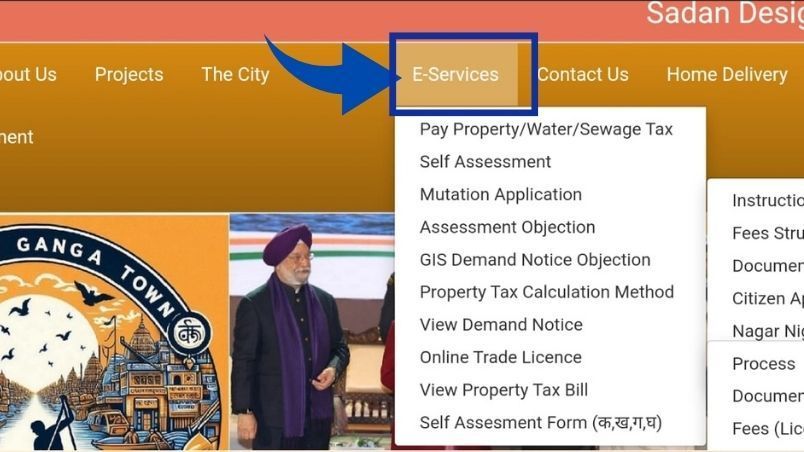

- You will be able to see the option E-Services on the menu tab above

- Click on the button

- Click on the option "property tax" appearing on the left side of the screen.

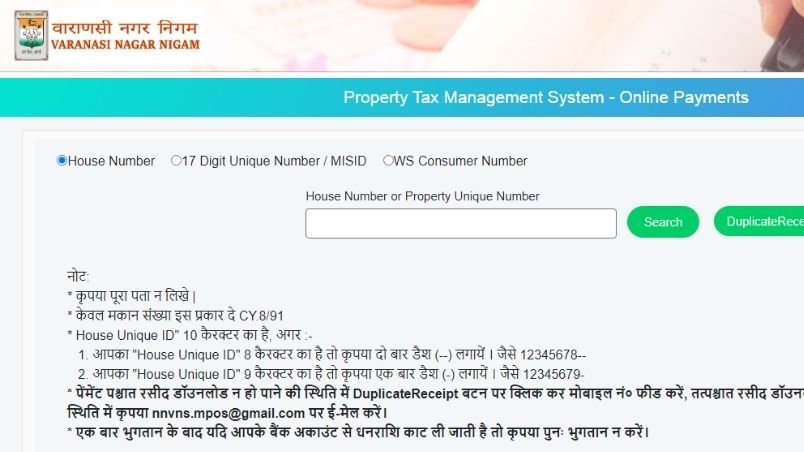

- You can fill in your house or create a Unique ID of 10 characters

- To check the house tax bill online in Varanasi. Click on the "see details" option

- You will be able to see your property tax due amount

How to Pay House Tax in Varanasi?

Government and local authorities ensure to motivate tax payees for timely payment. For this NNVNS has designed a rebate system for the Varanasi House Tax. All the taxpayers completing the payment within 30 days of its generation will receive a rebate of 10%.

On the other side if the payment is made after the lapse of 30 days the amount payable on the bill would attract a penalty of 10%. So paying tax on or before time can be beneficial for the property owners.

Pay House Tax Online Varanasi

To make Varanasi Nagar Nigam house tax online payment, the steps below can be followed:

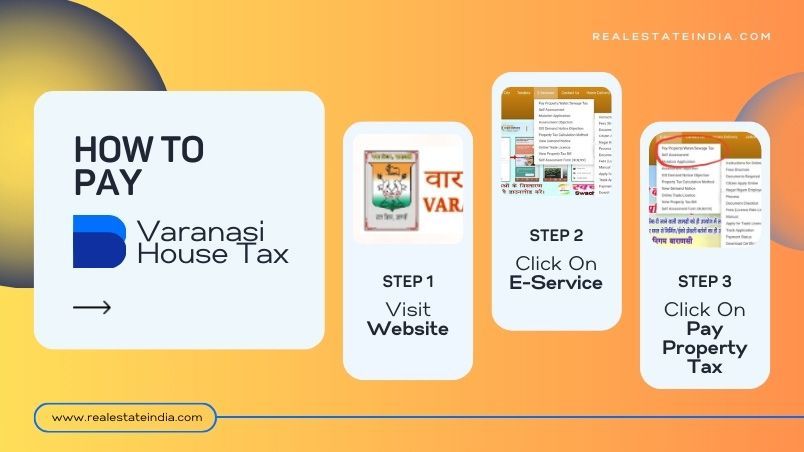

- Start by accessing the official website of the Nagar Nigam

- From the menu tab, select the “E-Service” option

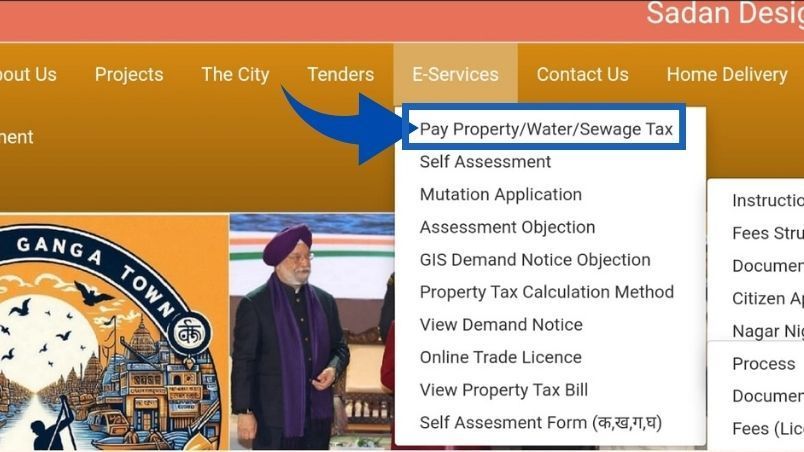

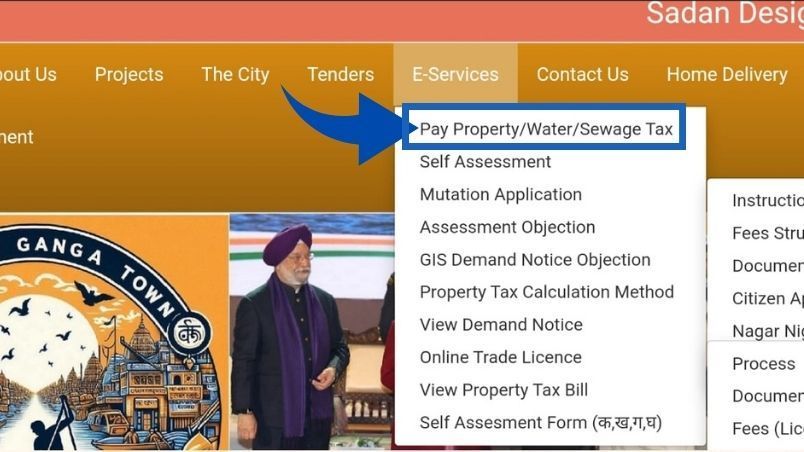

- From the dropdown menu click on “Pay Property Tax”

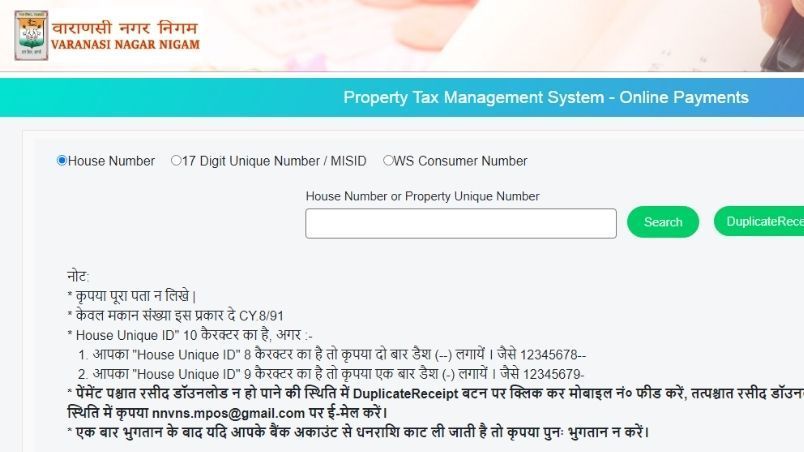

- Fill in your house number or unique property ID to fetch the details

- Select the option labeled as “See Details” button

- You will be able to view your due amount of the property tax

- An option of “Continue to Pay Online

- You can pay through any mode including credit, debit card, pay later apps, or UPI.

- Fill in all the required payment details

- Confirm the captcha verification and click on the “Pay Now” button

- Enter the OTP shared on your mobile number

- Once done you will receive the notification for successful payment

Pay House Tax Varanasi Offline

Apart from the online payment process, offline payment can be also done with these steps:

- Visit the nearby Nagar Nigam office or any other local authority to make the payment of property tax.

- You can take a property tax bill from an authorized person

- You will be required to share your proper property details including property ID or even house number.

- You can fill out all the required payment forms to complete your tax payment.

- You can make cash, cheque, or demand draft payments for the Varanasi house tax in offline mode.

- Don’t forget to collect your receipt once you have made the payment.

Some Additional Details for House Tax Check Online Varanasi

| Address |

Nagar Nigam Sigra, 221010 |

| Contact |

+0542-2221709 |

| Email |

nagarnigamvns@gmail.com |

What are the Late Payment Charges for House Tax in Varanasi?

The local authorities can induce a house tax penalty in Varanasi in case of late payments. Ensuring timely payment is very important to avoid any late charges or legal actions. If you don’t pay the property tax within 30 days of bill generation, you will incur an additional charge of 10%. This late payment charge is different for different locations like for BBMP property tax, 1% of the whole amount is added as a penalty

You can check the Late payment fees for house tax in Varanasi online via the official portal. Also, you can pay it along with the due amount.

Every property owner must ensure to pay the property tax Varanasi on or before October 31. Delayed payments will incur penalty charges.

Note: The local authorities can also take legal action against you in case of non-payment or delayed payments. Ensure to make timely payments to avoid any legal actions.

What is the rebate on Varani House Tax?

Government and local authorities ensure to motivate tax payees for timely payment. For this NNVNS has designed a rebate system for the Varanasi House Tax. All the taxpayers completing the payment within 30 days of its generation will receive a rebate of 10%. On the other side if the payment is made after the lapse of 30 days the amount payable on the bill would attract a penalty of 10%. So paying tax on or before time can be beneficial for the property owners

What are the House Tax Exemptions and Concessions in Varanasi?

The local governments of Varanasi provide certain property tax discounts in Varanasi and concessions linked to the property tax.

All vacant lands and buildings fall under the house tax exemption Varanasi category of the tax payment system. It comes in regulations under section 115 of the relevant legislation.

NNVS is offering a 10% concession on the property tax in Varanasi for the current financial year.

What are the steps to check the Nagar Nigam Varanasi house tax online payment receipt?

You follow the steps jotted down below for obtaining and checking your NNVNS house tax payment receipt online.

- Visit the official website of the NNVNS Payment portal

- Fill in your house number or property unique number

- Now click on the option “Duplicate Rceiept”

- Fill in your registered phone number

- The click on “Submit” button”

- You will be able to download your latest house tax receipt online.

Conclusion

Property owners in Varanasi must stay updated with the recent changes and applicable tax rates on property. Paying property taking is very important. Additionally, it benefits both the payee and the local government.

Moreover, technology development has also brought changes to NNVNS Payment. Now with the online portal Varanasi Nagar Niax tax management system is nothing less than a breeze. Payments and tracking are much easier now.

Proper knowledge of the charge, method of calculation, and payment procedure can help in making timely payments.

All the early payments within 20 days of production receive a 10% house tax rebate. Meanwhile, for late payments, 10% of penalty charges apply to the amount.

Q: How to check Varanasi house tax dues?

Ans: Owners can check the house tax dues on the official website of NNVNS, under the “Property Tax” section.

Q: Is it possible to pay Varanasi house tax in EMI’s?

Ans: No, the NNVNS doesn’t allow any EMI or installment payments. However, payers can utilize various modes of payment like Credit cards, Debit Cards, Net Banking, or UPI.

Q: Can I pay house tax online in Varanasi?

Ans: Yes, you can proceed with the house tax Varanasi payment online. You can leverage the official website of NNVSN.

Q: What documents are necessary for the NNVNS house tax payment?

Ans: To make an NNVNS house tax payment you only require your house number or unique ID. You won’t require any physical documents to pay the property tax.

Q: What should I do if I find errors in my property details on the NNVNS website?

Ans: In case facing any errors in property details, get in touch with customer care of NNVNS. You can mail at nnvns.mpos@gmail.com

ADD COMMENT