What is BBMP Property Tax?

The latest guidance-value based BBMP tax has been initiated on 1st April 2024. This new property tax will be collected annually by the civic body governing Bengaluru, namely, Bruhat Bengaluru Mahanagra Palike. The tax revenue will be used for the maintenance of infrastructural facilities, public places, schools, roads, sewer networks, and others.

The city of Bengaluru is divided into six zones. For each zone, the property tax is computed as per the Guidance Value System. This value is published by the Department of Stamps and Registration based on the property type, size, and amenities. Though the payment of tax is a burden on the homeowner, some of the perks that the locals enjoy by paying this property tax every year include-

- Better Infrastructure

- Improved healthcare and education system

- Transparency in tax computation

- Improved public places.

So, funding the state government of Bangalore is beneficial for the residents. By paying this tax you are making a commendable contribution towards the development of this city.

How to Get the BBMP Property Tax PID Number?

The Property Identification Number (PID) denotes the ward number, zone ID, and plot number. This number helps in record-keeping and identifying information related to a property online. Follow these steps to get your PID number online-

- Go to the official website

- Click on the option of GIS-based PID under Citizen Services

- Register or Log in to the portal

- Locate your property on Google Maps

- Enter the Payment Application Number and search

- The link of SAS no will be generated and you will get the details of the property with the PID number.

You can also get the PID number offline by following the below steps-

- Visit the BBMP ward office in person.

- Carry all the documents related to the property including property tax receipts, sale deed, etc.

- The concerned personnel will check out the documents presented by you and provide the PID number.

Sole owners of the property mostly need to be on their toes for the property tax-related tasks. But in case of fractional ownership, the asset management company handles all the records and pays the BBMP tax. Well, if you have any further queries, feel free to ask the officers or post the query online.

How to Pay Property Tax in Bangalore Online & Offline?

To pay property tax online, keep the PID handy. This can be availed by following the above-mentioned guidelines. Here, we provide a step-by-step guide on how to pay BBMP property tax online.

Online process

- Visit the official portal for property tax payments. BBMP Property Tax System

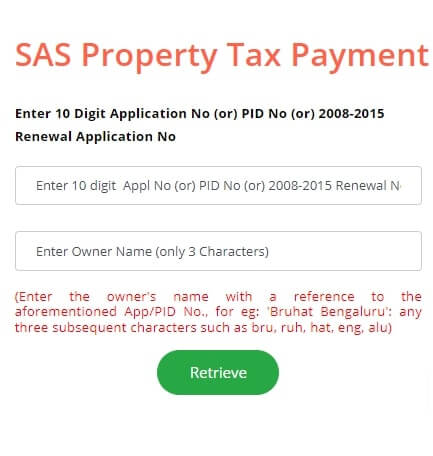

- The option for SAS property tax payment is available on the right side. Enter the application number or PID number or renewal application number. After that, enter the owner's name.

- Click on 'Retrieve' to fetch the property details and verify them.

- Check the tax amount calculated by the portal.

- Proceed to make the payment via any of the payment methods available. You can pay through net banking, credit or debit card, etc.

- Check out the payment receipt. After 24 hours, this receipt is available for downloading. You can download the receipt by clicking on the below link.

You can even update the property details on this portal. If there are any changes or corrections, click on the edit option and update. If you face any issues while paying the tax, you can get a solution in the following ways-

Email: dcrev@bbmp.gov.in

Phone No: 080 2297 5555

Helpline: 080 2266 0000

Offline Process

- Visit Assistant Revenue Office (ARO)

- Here, you need to carry either his 10-digit application number or previous property tax receipt. With the help of these documents, a challan will be generated by an official. Now you need to make payment through cash or Demand Draft. DD can be made in favour of Commissioner, Bruhat Bengaluru Mahanagara Palike.

- The Municipal authority has also authorized a few banks to accept the tax payment. Carry the challan generated from ARO to any of these banks and pay via the preferred payment method.

So, be it online or offline, payment of property tax is a prime responsibility of every property owner in the city. Better be prompt and pay the bbmp property tax before the deadline lapses.

BBMP Property Tax Late Payment

Late payment of any applicable tax attracts consequences or penalties. The same applies to the bbmp challan. A late payment charge of 1% is applicable on the total amount of tax liability per month.

For example, if the Karnataka tax due is Rs 5000 and the payer is late by 2 months, the late payment charge would be calculated as below-

Late payment charge = (Rs 5000 *1%) *2 months = Rs. 100 for paying the tax 2 months late.

Penalty and interest - Penalties do add up if the payer is a defaulter over a period of time. Regarding interest, there are no interest charges for payments made till 31st July 2024. After 31st July, interest will be charged @ 2 % per month on the unpaid tax amount.

- If the tax payment remains unpaid for less than a year, the penalty amount will be equal to the unpaid tax amount.

- If it is unpaid for more than a year (as of April 1, 2024), the penalty will amount to the sum of the unpaid tax levied and the interest @ 9% p.a. on a compounded basis. This has been recently enacted by the BBMP.

Beware! BBMP can even sue you if the charges stay due for a very long time. It is always better to pay the Bruhat Bengaluru Mahanagara Palike challan timely to adhere to the regulations for land tax in Karnataka. So, be a responsible citizen of the state and pay property tax on time.

The basic formula for calculating this much-discussed tax is-

K = (G-I) * 20% + 24% Cess

Confused? Well, here is the breakdown of all the key factors involved in calculating the property tax amount-

| K |

It denotes the Property tax to be paid. With the help of this formula, we are calculating this amount |

| G |

It is the Gross Unit Value. For different types of occupancy status, the value differs |

| I |

It is the depreciation deducted from the Gross Unit Value. Check out the link for clarity of rates. Depreciation Table |

It is the tenanted area/self-occupied area/ additional spaces* 10 months*rate per sq foot of the property space in question.

The Gross Unit Value is calculated based on Unit Area Value (UAV). The calculation of UAV is based on the expected rental income from a property considering its zone and usage. This UAV is then multiplied by the built-up area of your property excluding additional spaces to give Gross Unit Value (G).

Cess- An additional Cess of 24% on property tax (current rate) is applicable.

No doubt, keeping a tab on all the features of your property as per the prevailing rules is a task. To make it simple use the bbmp property tax calculator Bangalore available on the official website.

This link will also assist you on how to pay property tax online in Karnataka.

Calculation of BBMP Property Tax

Here, we present a walkthrough of calculating the Karnataka house tax, with an example.

Suppose Mr. Shyam owns a Bangalore Property and rented out the same. The tenanted area is 500 sq ft with no parking space. The rate per sq ft is Rs 20. The applicable depreciation rate is 10 % pa.

G= 500*Rs 20* 10months = Rs 100000

I = 100000 * 10%= 10000

K= (100000-10000) 20% + 24 % of property tax

= 18000 + 24% of Rs 18000

= Rs 22320

So, the Property tax Mr. Shyam must pay is Rs 22,320. Additionally, Mr. Shyam is liable to pay GST on the rental income earned apart from the property tax.

The following 6 forms are required by any real estate property owner in Bangalore for the payment of BBMP either online or offline.

| Name of the form |

Meaning and usage |

| Form I |

Used for properties having a Property Identification Number |

| Form II |

This form is used for properties having a Khata number. It is the record of the property in the property register maintained by the Municipal Authority |

| Form III |

Used for properties that neither have a Property Identification Number nor a Khata number |

| Form IV |

Used when there are no changes in the property's details like the occupancy, usage, or the total built-up area |

| Form V |

Used if there is a change in the details of the property |

| Form VI |

It is meant for paying the service tax if the property is exempted from property tax |

Due Date and Rebate for BBMP Property Tax

Here's good news for all the property taxpayers in Bengaluru. The due date for availing the rebate of 5% on property tax has been extended by 3 months. Earlier, the property tax bbmp last date was 30th April 2024 but now it's been extended to 31st July 2024, for the financial years 2024-25.

For a clear picture, go through the below table.

| Particulars |

Last date |

Rate |

| Rebate period |

Till 31st July 2024 |

5% on property tax amount |

| Penalty and interest |

Applicable after 29th Nov 2024 |

2 % per month on the unpaid tax amount |

| Penalty start date |

30th Nov 2024 |

2 % per month on the unpaid tax amount |

| Additional penalty for delaying by more than 1 year |

Unpaid tax amount + Accrued interest |

9 % per annum |

So, enables the authorities to function smoothly by paying the charges timely. Better not delay and pay your BBMP property tax before the 31st of July as we are under the current BBMP tax rebate period.

BBMP Property Tax Payment Receipt

Just paid your anekal property tax online? Well, that's great! But now you have for wait for 24 hours to download or print it. Just follow the below-mentioned steps and have access to it-

- Visit the official BBMP website of BBMP Property Tax System

- Enter your PID, property type, and zone to get the details.

- Now, click on the 'print receipt' option under the Download section.

- Select the Assessment Year and enter the application number or PID.

- Then Click on Submit.

The receipt for your Municipal tax online payment in Karnataka will be generated. You can print or download the same.

If the amount is paid through offline channels, the bank acknowledgment slip will be presented at ARO. The official will then view and print the receipt of the Bangalore property tax.

BBMP Property Tax System

A grievance or complaint can be regarding any major issue like road maintenance, malfunction of drainage system, waste management, animal control, etc. You can register a complaint in the following ways-

- Click the online grievance tab on the official portal of Bangalore Municipal

- You can call on the helpline number 080-22660000

- The grievance can be registered by sending an email to comm@bbmp.gov.in.

- You can always visit the Head Office in Bengaluru and get the complaint registered and resolved.

A reference number for the filed complaint is provided to track the status.

What Kind of Properties Attract Property Tax in Bangalore?

Here is a list of residential and commercial properties that attract this tax

- Self-occupied houses like villas or flats,

- Rented out houses and flats,

- Office spaces,

- Shops,

- Godowns or warehouses,

- Factories,

- Vacant land,

So, just like Aurangabad property tax, Mysore Property Tax, and Nagpur Property tax. This levy is also imposed on owners of the above-mentioned property types.

What is the BBMP Property Tax Rate in Bangalore?

Guidance value-based property tax is charged on different types of properties in Bangalore. Guidance value is the base value assigned by the government to a particular property or land based on their zone. The rates are as follows-

| Property type |

Tax rate on Guidance value (%) |

Tenanted residential property |

0.2% |

| Self-occupied residential property |

0.1% |

| Vacant land |

0.025% |

| Occupied commercial property |

0.5% |

FAQs on BBMP Property Tax

Q1. BBMP property tax 2024 payment deadline

The deadline for paying this tax is 31st July 2024. Earlier it was 30th April. However, due to the Lok Sabha poll, the deadline for BBMP payments was extended by 3 months. So, pay it by 31st July as it is also the BBMP property tax rebate last date.

Q2. How to check the status of tax-paid application?

After 24 hrs. of payment, click on the option of ' Receipt Print' under the Download section. From here you can fetch your receipt.

Q3. Contact information for BBMP property tax

Email- comm@bbmo.gov.in

Phone- 080-22660000

Head Office Address: Hudson Circle, Bengaluru, Karnataka 560002, India

So, if you have any queries about how to pay the property tax in Bangalore, just contact the Municipal Corporation and get your query resolved.

Conclusion

So, here we conclude that the payment of BBMP property tax is essential for the maintenance and development of the city. The property owners can pay their dues online via the official portal and offline by visiting the ARO. Keep track of the deadlines and be a responsible citizen by timely paying BBMP property tax in Bangalore. If you have any queries about how to pay the property tax in Bangalore, just contact the Municipal Corporation and get your query resolved.

Keep track of the deadlines and be a responsible citizen by timely paying BBMP property tax in Bangalore. If you have any queries about how to pay the property tax in Bangalore, just contact the Municipal Corporation and get your query resolved.

ADD COMMENT