Latest News on Nagpur Property Tax

- New #1: NMC has recently proposed a hike of 4% in property tax rate over five slabs. It has even proposed to increase the rate of five other taxes within a range of 1-2%.

- New #2: NMC will grant a rebate of 8% to those paying their property tax by April 30th, 2024. The rebate will be provided on the annual property tax for the current fiscal year. Moreover, an additional rebate of 1% will be granted to the online payers.

- New #3: During the budget of FY 2023-2024, the corporation took the initiative of offering a 5% rebate of tax amount if the payment is made online.

- New #4: An additional rebate of 10% is provided if the payment is made by 30th June 2024. So, if the NMC tax payment online is made by 30th June, 20204, a total rebate of 15% is provided.

- New #5: As per the Abhay Yojana Amnesty Scheme 2023-24, the government is offering a discount of 80% on the tax penalty amount to the defaulters. However, this can be availed only if the total outstanding dues are cleared by 31st March 2024.

For the latest updates, keep checking the NMC official portal as the rates and rules keep on changing. Now, let's get to know about the identity of this tax in depth

What is Nagpur Property Tax?

Property owners in Nagpur are liable to pay NMC property tax. It is collected by the Nagpur Municipal Corporation. The revenue so collected is used for funding different amenities like, sanitation, drainage systems, public health, education, infrastructural development, and much more.

The owners of all types of properties like commercial, residential, or vacant properties are liable to pay tax to the Nashikmunicipal. As per the MMC Act, this civic body in Nagpur is empowered to hike the tax rates every year. This charge acts as a major source of revenue for the Municipal authority and the residents must fulfill their obligations to comply with the norms of the city.

So, just like Aurangabad property tax, Mysore property tax, BBMP tax in Bangalore, GHMC property tax in Hyderabad, and BMC property tax in Mumbai, this tax is meant to be paid by the property owners to the Municipal Corporation.

Who Needs to Pay the NMC Nashik Property Tax?

Anyone who owns a property in Nagpur needs to pay the NMC house tax. Owners of different types of properties are subject to varies tax rates. So, if you are an owner of any of the following property types, then you are liable to pay NMC Nashik Property tax -

- Residential- Like bungalows, villas, flats, etc.

- Commercial- Like offices, shops, hotels, etc.

- Industrial- Like factory, warehouse, etc.

- Vacant land- Land meant for open use within the city limits.

Even if you have fractional ownership of any of the above-mentioned property types, NMC tax Nashik is surely your liability.

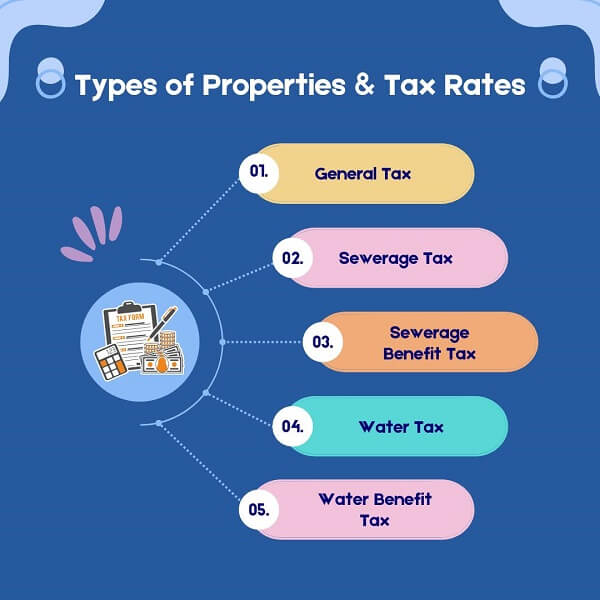

Types of Properties and Tax Rates

Different types of properties are subject to different rates. These rates are determined by the Municipal Corporation after a thorough analysis of various driving factors. The Nagpur property tax is calculated on the basis of Annual Letting Value, which is based on the expected annual rent per square meter. The property tax rates vary based on the ALV. Let's check out the property rates for 2023-2024

Property Tax Rates (2023-2024):

- General Tax:

- ALV ₹1 to ₹2000: 14%

- ALV ₹2001 to ₹5000: 18%

- ALV ₹5001 to ₹20,000: 22%

- ALV ₹20,001 to ₹50,000: 26%

- ALV ₹50,001 & above: 30%

- Sewerage Tax: 12% on all ALV

- Sewerage Benefit Tax: 1% on all ALV

- Water Tax:

- ALV ₹1 to ₹2000: 10%

- ALV ₹2001 to ₹5000: 12%

- ALV ₹5001 & above: 15%

- Water Benefit Tax: 1% on all ALV

- Fire Service Tax: 1% on all ALV

- Municipal Education Tax: 1% on all ALV

- Tree Tax: 1% on all ALV

- Special Conservancy Tax (for specific properties):

- ALV up to ₹50,000: 7%

- ALV ₹50,001 & above: 10%

For further info and clarity on rates, check out this file and get to know how the rates are levied by the authority.

Factors influencing NMC Nagpur Property tax

- Location- The location of the property is a major driving factor in determining the property tax in Nagpur. Posh areas generally have a high market value and therefore have to incur higher taxes.

- Carpet area- It is the usable floor area of a building excluding the balconies.

- Property type- The property type like residential, commercial, industrial, or vacant land is also taken into account while determining the tax figure.

- Construction- Strongly constructed buildings attract a higher tax amount than mediocre ones.

- Ready reckoner rate- The city is divided into blocks and different rates are assigned to each on the basis of the market value. So, if you own a property in a block having a higher market value, then be prepared to pay a higher tax amount.

- Type of occupancy- Being rented or self-occupied affects the application of tax rate. Residential properties that are self-occupied might attract some concession on the value as compared to rented ones.

- Age of the property - Newly developed buildings may face a higher NMC Nashik property tax than the older ones.

Property Tax Nagpur- Check Last Tax Receipt

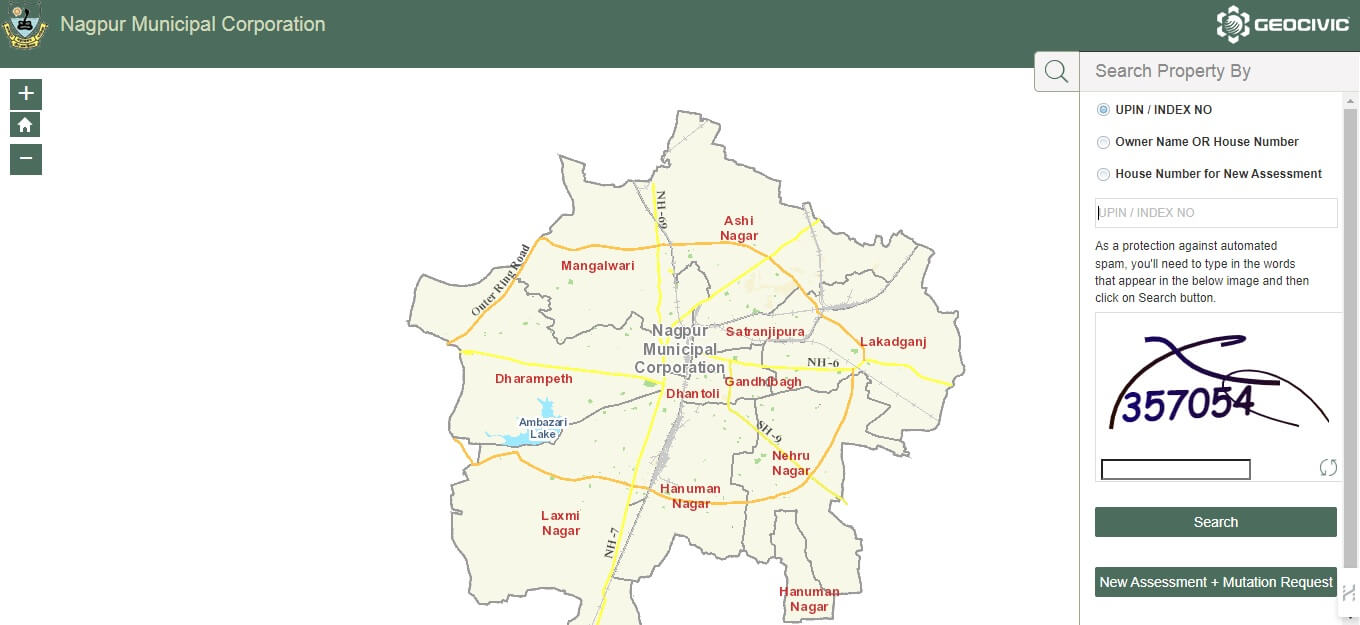

It is always better to keep a record of your last NMC property tax payment receipt. But in case you have misplaced it, no worries! You can find the same by following the below-mentioned steps-

- Click on the Section of Services

- Check out the section on Property Tax

- Fill in the index number or House no. or Owner's name

- After that, enter the captcha correctly

- Then click on the Search tab

- The website would display the last Nagpur property tax receipt.

If you need any further assistance regarding NMC tax receipt, feel free to contact the department. The contact details are easily available online.

How to calculate Nagpur Property Tax?

The property tax in Nagpur is calculated on the basis of the Annual Letting Value (ALV) of the property in question. This value is derived on the basis of several factors like,

- carpet area

- property type

- block classification

- age of property

- type of construction

- occupancy type

- number of floors and much more

A standard deduction of 10% is then made by the department from the build-up area to derive the annual letting value.

The property tax is calculated by multiplying this ALV with the specific NMC property tax rate. This gives the figure of tax amount.

Other charges like water tax, sewerage tax, fire service tax, etc. can also be added to the tax rate.

Property tax= (base rent per sq mtr *carpet area) * Tax rate based on ALV

Let's make it more apparent with an example- (Rs. 50 * 100sq.mtr.) 18%

Tax amount= Rs. 900

Calculating Annual Letting Value for NMC Property Tax

Annual Letting Value is the tentative annual rent amount that a property owner can earn by renting the asset out. This is a prime factor in calculating the NMC property tax. The value is determined based on several factors such as age, location, carpet area, amenities, etc. of the property. There are two ways of deriving it-

- Refer the online payment portal - The NMC portal automatically calculates the ALV. Just click on the Property tax option under the section of services and fill in the required details. Opt for the Self Assessment Excel Sheet and a spreadsheet will appear for you reference to calculate the Annual Letting Value. or directly click on this link GeoCivic - Citizen Portal

- Check the Past property tax bill- Moreover, you can always check out the past tax bills online or offline. ALV is definitely mentioned on them.

How to Pay Nagpur Property Tax?

The property owners can pay the property tax online and offline as per their convenience. Let's check out how to make pay NMC property tax-

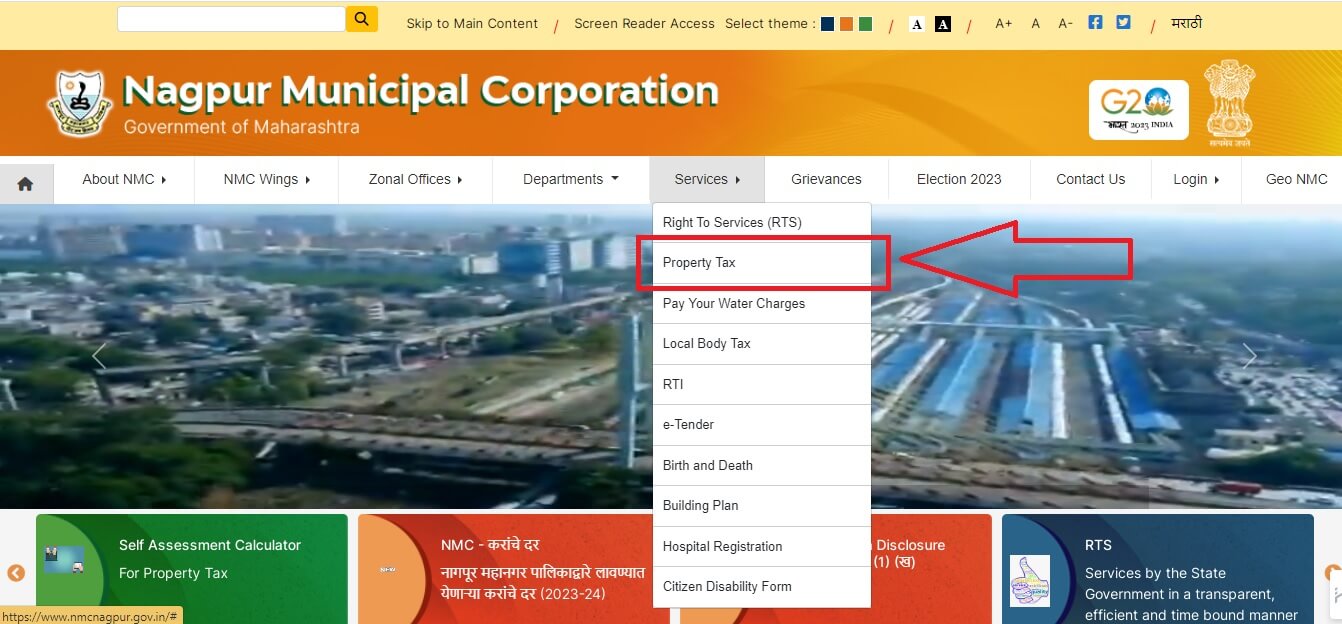

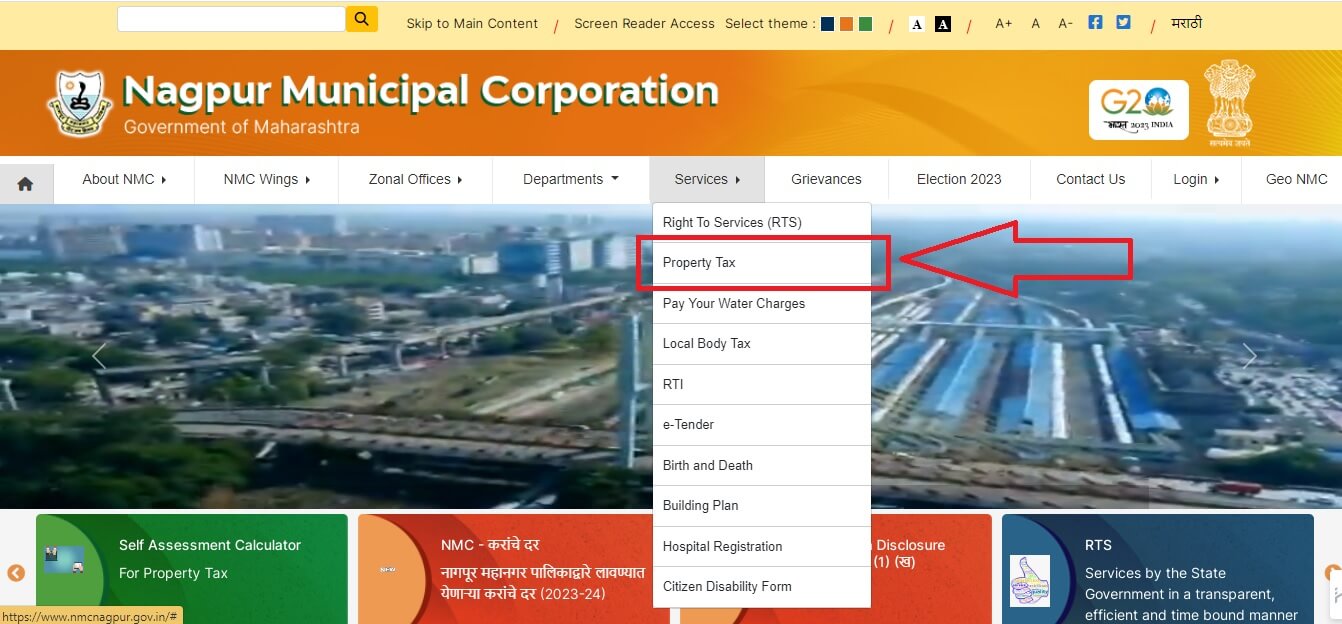

Online Payment Method

Here we present a step-by-step guide to paying Nagpur property tax online

- Click on the Service tab and select the option of Property Tax

- Then fill in the Details and Press the option of Search.

- The Tax amount to be Paid will be displayed

- Choose the Option of Pay Tax and Generate Receipt

- Select your preferred online payment option like netbanking, credit card, UPI, etc.

- Then follow the instructions and complete the Payment.

- A receipt will be displayed after the payment is successful.

Furnishing the NMC Nagpur Property tax online is a super convenient option. So, pay online and meet the deadlines. From this portal, you can even pay Nashik Mahanagar Palika water bill.

Offline Payment Method

There's always an option to meet the property tax obligation in the traditional offline way. Just follow these steps and mee the property tax demand -

- Visit the ward office of Nagpur Municipal Corporation or Authorized banks with the required documents like past property tax bill, photo ID, etc.

- The staff working there will generate the challan based on the documents presented by you.

- You can make the payment via cash or Demand draft to furnish the nmctax.

Property Tax Rebates and Penalties

Rebates and discounts

- Early payment rebate- Pay NMC property tax online before 30th June 2024 and avail a rebate of 15% on the total property tax 2024. If you pay your property tax offline before 30th June 2024, then you are subject to a rebate of 10 % on the total amount. So, you better pay online and get a higher rebate.

- Self-occupied residential property- The NMC property tax Department might offer rebates for self-occupied residential properties

- Senior citizen discount- There has been a proposal for a 10% rebate for senior citizens in order to make them manage their property tax obligations. However such proposals have been rejected by the NMC.

- Others- Certain rebates and exemptions are available to educational institutes, charitable institutions, religious establishments, agricultural lands, gov buildings, owners who are physically challenged, and others. For the exact information, it is better to contact NMC.

For any further assistance related to property tax and eligibility for rebate, feel free to contact the authority.

Penalties and Interest

The last date to pay the NMC property tax is 31st December. Those paying later than that are subject to an interest penalty of 2% of tax amount per month.

The eligibility for rebates and imposition of interest penalty can be better understood by the below-mentioned table-

| Payment date |

Mode of payment |

Percentage of discount or penalty applicable |

| By 30th June, 20204 |

Offline |

10% discount on the bill |

| By 30th June, 2024 |

Online |

15% discount of the total amount |

| Between 1st July and 31st December |

Any mode |

No discount or penalty applicable |

| After 31st December 2024 |

Any mode |

2% late payment interest penalty per month |

So, hurry up guys! Pay property tax on time and avail the discount lest you might get the burden of tax penalty.

FAQs on Nagpur Property Tax

Q1: How do I find my property tax index number?

A: You can find the property index number on the previous year's payment receipt.

Q2: Can I pay property tax in installments?

A: Yes. The taxpayers have the option to pay the amount in installments or in full for each year.

Q3: What documents are required for property tax payment?

A: For online payment, UPIN/index number or owner's name or House number are required. And, for offline payment, previous year's tax receipt, photo id, and property related documents are required.

Q4: How can I check my property tax dues?

A: Just visit the homepage of Nagpur Municipal Corporation and select the option of Property tax under the tab of Services. Fill in the required details and click on the Search option. The due amount will be displayed.

Q6: How often is property tax revised in Nagpur?

A: As per the Maharashtra Municipal Corporation Act, the NMC can revise the bill every year.

Q7: Are there any exemptions or concessions for specific property types?

A: Yes, there are exemptions and concessions for agricultural land, land owned by the government and corporation, plots meant for religious and charitable purposes, educational institutes, and public burial grounds, and properties owned by political parties recognized by the Election Commision of India. Certain concessions might be available for self-A: occupied residential properties and owners who are physically challenged.

Q8: Can I apply for a property tax refund?

A: In case of excess payment made, feel free to contact the Online Grievance Redressal System on the website. New Complaint Registration (nmcnagpur.gov.in) You can also visit the zonal office and request for a reassessment. Keep the necessary documents like, receipt showing overpayment, documents showing correct valuation, Photo ID, etc. handy.

Q9: How can I get a duplicate NMC property tax receipt?

Visit the official website, click on the option of property tax under the tab of services. Fill in the details and Search. Then select the option of 'Check your Last Tax Receipt'. You can also visit the zonal office and retrieve the same.

Additional Resources

Online payment link- GeoCivic - Citizen Portal

Homepage of NMC-: nmcnagpur.gov.in

Contact details-

Address- Chhatrapati Shivaji Maharaj Administrative Building, Nagpur Municipal Corporation, Mahanagar Palika Marg, Civil Lines, Nagpur, Maharashtra, India, 440 001

Contact Fax: 0712 2561584

Mail Us- mconagpur@gov.in, nmcnagpur@gmail.com, nmcngp.media@gmail.com

Conclusion

Well, it is a paramount responsibility of every citizen to duly pay the charges and contribute towards city's development. Paying it timely not only avoids penalties but also make it easy to sell your property in Nagpur. You can always check out the user-friendly portal of NMC for paying the dues and avail attractive rebates and discounts.

For any assistance regarding property assessment or any other issue, feel free to contact the NMC by calling or writing to them. The staff working behind the portal is highly cooperative and prompt to solve all your queries. So, hurry up guys! the last date to claim the rebate i.e. 30th June is approaching near. Pay it online and get benefitted.

ADD COMMENT