Among the top 100 cities in India Indore is the one selected under the Smart City Mission. But to term it a “Smart City” requires a lot of infrastructural and needful developments. In line with this, completing these developments without any revenue isn’t easy for the local authorities. The IMC Property tax is the main source for collecting and generating revenue for developmental processes in Indore.

Indore Municipal Corporation takes charge of Property tax management processes. However, there might be certain users struggling to fight the right tax levied, calculation, and payment process. For them here is the go-to guide for IMC Indore property tax covering all the needful property tax details.

What is IMC Property Tax?

Irrespective of the type of property, every property in Indore, Madhya Pradesh falls under the category of Property Tax. All property owners or residents must make timely payment of their property tax. The revenue collected in the form of tax is for developments like:

- Constructing or Maintaining Roads

- Building community hubs or parks

- Maintenance of Public Amenities

- Urban Development Projects

If we look at the past the IMC was established in 1870 and reconstituted as a municipal corporation in 1956. It plays a very important role in overlooking the tax payment process. The whole department helps in assessing property values and determining the applicable tax rates along with ensuring timely collection.

How to Check Your IMC Property Tax Bill?

To pay the property tax bill it’s quite important to know how to check the tax bill. You can check the IMC Indore property tax bill both through online and offline modes. Following the offline mode you have the visit a nearby municipal corporation center and for the online process use these steps:

- Access the official IMC website

- In the header, there is an option for “Online Services”

- Hover on the option

- Under the “Payment and Taxes” category, an option states “Bill Tracking”

- Click on the option

- Fill in all your details on the “Bill Tracking Portal”

- You can now track your bill and check your tax amount for Indore IMC Property tax

What are the Types of Properties Under IMC Property Tax?

Be it a residential property or a commercial one the Indore Municipal Corporation imposes tax on every property. However, the applicable tax rates may vary considering several factors like Annual Rental Value, Size of property, and usage.

IMC Property Tax on Residential Properties

Houses or properties that are brought into use for living purposes are known as Residential properties. These can be of various forms like independent houses, flats, villas, or multipurpose houses. The tax rate applicable on such properties is comparatively low from commercial ones. In general, the tax rate ranges from 0.5% to 1% in Indore.

IMC Property Tax on Commercial Properties

All the properties utilized for business use fall under the category of commercial properties. For example, the properties used for building offices, retail shops, restaurants, cafes, and hotels are termed to be commercial property. Following the ARV calculation process, the Indore property tax rate for these properties ranges from 0.6% to 1%

IMC Property Tax on Industrial Properties

Other than commercial properties, industrial properties are the properties that are used for manufacturing, processing, or the purpose of storing goods. All the factories and warehouses come under this segment. However, the applicable tax rate for industrial properties is generally higher when compared to commercial properties. The property tax in Indore vary following the location and types of use. The rate can vary from 1% to 1.5% depending on the specific location of the property.

IMC Property Tax on Vacant Land

All the lands that are not designed for any other purpose like residential, commercial, or industrial areas fall under the category of Vacant Lands or plots in Indore. These lands are also subject to property tax liability. There is a slight difference in the tax rates for vacant lands in urban and rural areas, For urban areas the approximate value is 0.2%, and for rural areas, it is about 0.1%.

How is IMC Property Tax Calculation done?

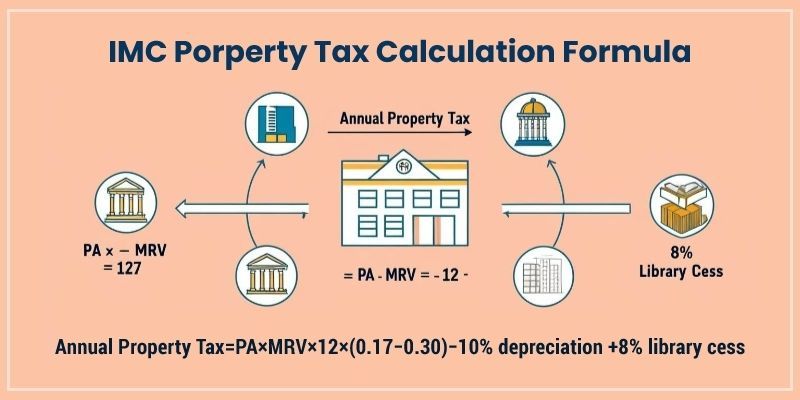

Unlike the NNVNS Property tax payment and BBMP Property tax, the Indore tax payment doesn’t follow ARV consideration, it follows the values listed below:

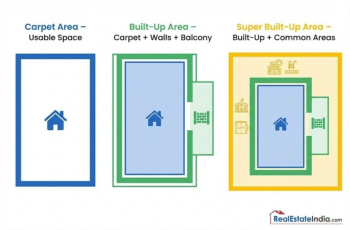

1. Plinth Size (PA)- The total built-up area of the property that includes garages, balcony, and any lobby.

2. Monthly Rental Value- Instead of Annual Rental Value, the IMC Indore property tax requires the monthly rental value of the property.

Calculation Formula for Indore Municipal Corporation Property Tax

Annual Property Tax = PA×MRV×12×(0.17−0.30)−10% depreciation +8% library ces

Example of Calculating Indore Nagar Nigam Property Tax

Let's understand the above formula with the details below:

- Plinth Area: 1,000 sq. ft.

- Monthly Rental Value: Rs 20 per sq. ft.

Calculate Annual Rental Value: Annual Rental Value=1000 sq ft×₹20/sq ft×12=₹240,000Annual Rental Value=1000 sq ft×₹20/sq ft×12=₹240,000

Estimate Property Tax:

Assuming a tax rate of 0.25

Annual Property Tax=₹240,000×0.25−10%+8%

After applying depreciation and cess:

=₹240,000×0.25−₹24,000+₹19,200=₹60,000−₹24,000+₹19,200=₹55,200

How to use Automatic Indore Property Tax Calculator?

You can also bring the IMC Indore property tax calculator, available on the official website of Indore Corporation in use to find the right amount. To do so follow these steps:

- Access the official website of the Indore Municipal Corporation

- Locate the option for "Paying Tax and Charges"

- Hover it to see the property tax option

- In the sub-menu of "Property Ta Option," you will find the "Payment via Property ID" option.

- Click on it to search for your property

- Search your applicable tax amount with your property ID

How to Pay Indore Property Tax?

Payment of tax in Indore can be done via both online or offline modes. However, it totally depends on the user what mode suits them the best

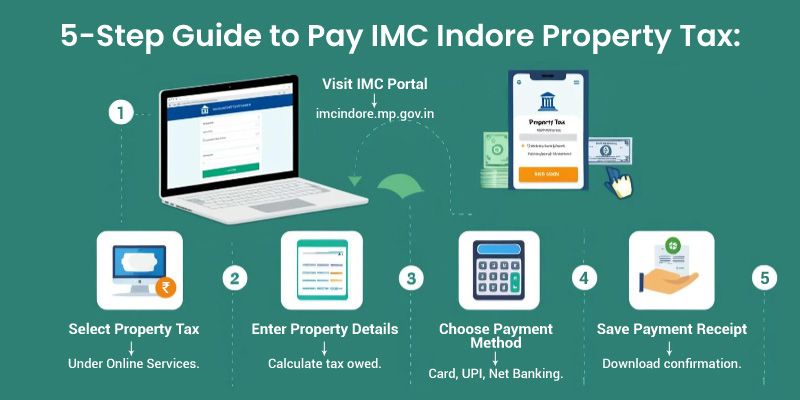

How to Make IMC Property Tax Payment Online?

With digitalization in use, it has now become quite easier to make the Indore property tax payment via Online payment mode. Here are the steps you can follow to make IMC property tax payment through online mode:

- Start by accessing the official IMC portal at https://imcindore.mp.gov.in/

- Under the Online Services option, is the option for “Property Tax and Charges”

- Click on the “Property Tax” option under the “Property Tax and Charges” section

- Click on the option, “Pay your taxes”

- Fill in all the property details to fetch your payable amount

- You can complete the payment via multiple payment methods including Credit Card, Debit Card, Net Banking, and UPI ID.

- Once done with the process to pay your property tax, download the receipt for IMC Indore property tax online payment.

How to Pay IMC Property Tax Offline?

Another payment option to pay the tax is via offline payment mode. To make payment of property tax following the offline mode you can adhere to these steps:

- Take a visit to the IMC Authorized office or any nearby municipal corporation

- Take a form for the property owner in Indore to pay the tax.

- Ensure to take all your necessary property documents

- Fill out the form to pay property tax in Indore

- Pay the property tax amount either in form of cash or any other payment mode

- Obtain your IMC property tax receipt after the annual property tax payment

What are the rates for various properties under Municipal Corporation Property Tax?

| Type of Property |

Property Use |

Area Type |

Tax Rate / Slab |

| Residential |

Self-Occupied |

Urban Area |

0.5% of ARV |

| |

Rented |

Urban Area |

1% of ARV |

| |

Self-Occupied |

Rural Area |

0.3% of ARV |

| |

Rented |

Rural Area |

0.6% of ARV |

| Commercial |

Shops, Offices |

Prime Urban Area |

2% of ARV |

| |

Shops, Offices |

Non-Prime Urban Area |

1.5% of ARV |

| |

Shops, Offices |

Rural Area |

1% of ARV |

| Industrial |

Factories, Warehouses |

Industrial Zones |

1.5% of ARV |

| |

Factories, Warehouses |

Non-Industrial Zones |

1% of ARV |

| Vacant Land |

Residential/Commercial |

Urban Area |

0.2% of Market Value |

| |

Residential/Commercial |

Rural Area |

0.1% of Market Value |

| Institutional |

Schools, Hospitals |

Any Area |

0.5% of ARV |

| Mixed-Use |

Residential + Commercial |

Urban Area |

Combined Rate Based on Usage (Proportional Calculation) |

Understanding Your Indore Property Tax Ledger

To define a property tax ledger we refer to all the detailed records that the local authority of any region maintains to keep track record of all the payments. All the documents and details related to property tax are kept saved and secure.

Key Features of IMC Indore Property Tax Ledger

Here are the features of keeping the tax ledger updated:

- It helps in maintaining the payment records

- It contains essential important and details about the property

- With IMC Property Tax Ledger in user, tacking timely property assessment becomes easier

- It can be used in the form of legal documents to solve any property disputes and verify ownership

Conclusion

Paying property tax may appear a burden for some but it is very important for developmental projects. Similarly, Indore Property Tax payment generates revenue to help authorities with developmental projects. Owners can pay the tax online or offline depending on their choice. So you must ensure to pay the IMC property tax in Indore without any delay that even saves you from any legal actions.

Frequently Asked Questions About IMC Property Tax

Q: How can I check my property tax bill on IMC Portal?

Ans: You can check the property tax bill through the official website of IMC. You can even make the online property tax.

Q: What if I do not pay my property tax on time?

Ans: Late payment of property tax can result in an improvement of financial penalities. It can also result in legal action.

Q: How can I dispute my property tax assessment?

Ans: To dispute your property tax assessment follow these steps:

- Read the assessment notice

- Collect needful evidence

- Submit a formal appeal

Q: Are there any exemptions or discounts available?

Ans: Yes, there are exemptions available on payment of Indore property tax. A 6% discount on property taxes was made before May 15.

Q: What is the last day of the Indore Tax payment for Properties?

Ans: The last day of property tax payment in Indore is June 30 of each year

ADD COMMENT