What is VVCMC property tax?

The governing body of Vasai-Virar City Municipal Corporation was formed in 2010 and it looks after the civic administration of the city. It charges annual property tax from the property owners of different property types falling under its jurisdiction. The residents mostly use the Marathi term 'Ghar Patti' for property tax. The house tax so collected is used by this municipal body for the upkeep of the city. This ultimately benefits the residents in several ways, like better quality of life, uplifting property prices, etc.

To make the process comfortable for the residents of Maharashtra, the Vasai Virar Municipal Corporation offers a property tax online payment portal. So, you can now pay your property tax online via the official portal of VVMC. Those who do not find the online payment process comfortable can pay property tax offline by visiting the Main Office. Just read on to find the complete Address and Contact info.

Some of the important terms that you as a reader and taxpayer must be well aware of are listed below-

- Ghar Patti- Broadly, this Marathi term is used by the people in Maharashtra for 'house tax'. Different Municipal authorities in Maharashtra levy different property taxes like Panvel property tax, Nagpur property tax, etc. The Maharashtrians denote them all as ghar patti. So, if you own a property in Maharashtra, then you must pay Ghar patti or house tax to the respective governing body in your locality.

- Assessment number- The assessment number is a unique number assigned by the municipal corporation to identify a particular property. This number assists in VVCMC property tax payments. This reference code helps identify various details about the property like, location, title of ownership, tax payment history, etc. It helps in keeping the property records and updating them from time to time. You can check the property tax bills to know your Assessment number. This 10-digit number would look like XYZ123ABCD.

- Property ID- Property ID or PID number is a unique 15-digit number assigned to a property. The digits denote ward number, street ID, property type, size category, etc. It is assigned by the local tax authority of a city for record-keeping. It helps in fetching out the assessed value of a property which helps in determining the taxable amount. You can find it on your tax bill and it might look like 763-345-RZX-123-ABC.

What are the Benefits of Paying VVCMC Property Tax on Time?

You get several advantages on paying VVMC ghar patti on time. Apart from making you a responsible citizen, it even benefits you in several other ways like-

Paying the Vasai-Virar City Municipal Corporation property tax bill on or before the due date i.e. 31st December can make you enjoy a 1% rebate on the total amount. Moreover, if you have paid property tax for the preceding 5 years within 15 days from the date of bill generation, then you can get the benefit of a 15% rebate on the tax amount of the current year's liability.

The defaulters are liable to pay a 2% penalty per month on the outstanding amount. So, be it online or offline, pay it on time and avoid late payment charges from the side of the Municipal body.

If the property tax revenue is earned by the authority as per its plan, then it helps make the city a better place. This is because the funds are readily available for the regular upkeep and maintenance of the civic amenities.

So, make house tax payments on time and fetch benefits in every way possible. Well, those who make it after the due date, face late payment penalties

How is VVMC Property Tax Calculated?

Several factors influence the property value and tax to be levied. There is no uniform rate that suits all properties. The rate and property value are derived by tracking many factors. Let's check them out

The value of a property largely depends on the ward and zone it is situated in. The city is divided into different zones like Virar East, west, north, and south. The VVMC further divides the city into different wards, each having a different standard rent set by the Municipal body. This standard rent plays a major role in determining the tax value. Posh localities mostly have a higher standard rent.

In Vasai Virar, carpet area is considered for calculating the property area. Many municipalities take built-up areas as a major factor, but Vasai Virar City Municipal Corporation calculates the tax based on the carpet area only. It is the floor space available for use within the walls of the building. It excludes balconies, verandahs, common walls, and other spaces not used for living.

Let's understand it with the help of a table

| Basis of Diff |

Built-up area |

Carpet area |

| Meaning |

It is the total area lying within the external walls of a property |

This is the usable floor space within the walls of a property |

| Inclusions |

External and internal walls, balconies, terraces, and staircases within the building |

Main rooms like bedrooms, living room, dining hall, kitchen, bathroom, partition walls within the building |

| Exclusion |

Lobby, lift, staircase outside the building wall |

External walls, balconies, terrace, and all types of staircases. |

| Role in calculating property tax |

Not considered by the VVMC |

Used by the VVMC for property tax calculation |

The type of property in question also is a major determining factor for property tax. Residential, commercial, and industrial property are different property types. A few examples of them are-

- Residential- Apartments, Villas, houses, bungalows, condos, townhouses, etc.

- Commercial- Offices, shops, showrooms, hotels, restaurants, etc.

- Industrial- Warehouses, factories, etc.

Each of them is subject to different property tax rates and property valuation.

Materials used for building a property do have an impact on its valuation and tax calculation. Those made with a strong material like RCC have a higher market value and a higher tax amount. Those having a simple construction with brick-and-mortar face lower tax liability. The city witnesses several Patra shed properties too. These are made with no to less construction materials and lack strength. Such Patra Sheds have quite low property and tax value.

VVCMC has its own set of rules and data for determining the approved rent for a particular area of the city. This factor plays a big role in the property tax in the city of Vasai-Virar, Mumbai. The standard rent and rateable value* of a property assist in determining the Approved rent for a property in question. Further in this article, we will provide in-depth information on standard rent and rateable value. So, just read on.

*Rateable Value- It is the annual rent that a property can fetch in the market. This is an estimated value based on which the tax is calculated. High societies have a higher rateable value and vice versa. The formula for calculating rateable value is

Rateable Value = (Standard Rent per month* Area *12 months)- 10% standard Deduction

Here,

- Standard rent is the monthly rental value of the property assigned by the Municipal board based on location, property types, building structure, etc. Thus, it is different for different zones and wards within the city.

- The area is the carpet area of the property in question

- Standard Deduction is applied by the VVMC @ 10% for administrative convenience and accounting for maintenance and vacancy period.

How to Pay VVCMC Property Tax?

Online Payment Methods

The payment of VVCMC property tax online can be made via the user-friendly portal of the Vasai Virar corporation. Just follow the below-mentioned steps-

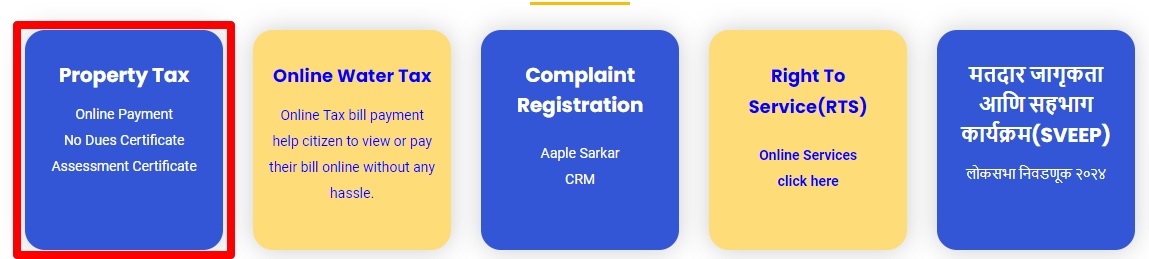

- Visit the official portal

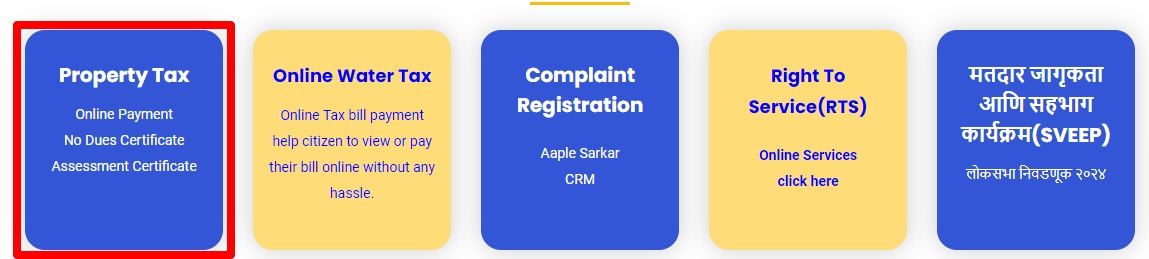

- Click on the Option of Property Tax and then opt for Online Payment

- Fill in the details of the property and verify the tax amount displayed on entering the details

- On this page, you will also get details like property tax for 5 years or one year, discount amount, and the final amount to be paid.

- Then, you can proceed to pay the tax amount via different options like net banking, credited card, etc.

- After choosing a suitable option make the payment

- After the payment is successful, click on the download receipt option.

So, your property tax is paid just by following these simple steps. So, pay taxes online at your convenience and be a responsible citizen of this city. Those who have fractional ownership of the property can delegate the task to the Assent Management Company. These companies are responsible for maintaining the properties and recording the tax payments.

Well, the payment can be made offline too in the following manner-

Offline Payment Method

Visit the Main office of VVMC with all the necessary documents. The staff working there will get the challan generated based on the details provided. You can pay the challan amount via cash or Demand Draft.

How to Check VVCMC Property Tax (Gharpatti)?

Online Process

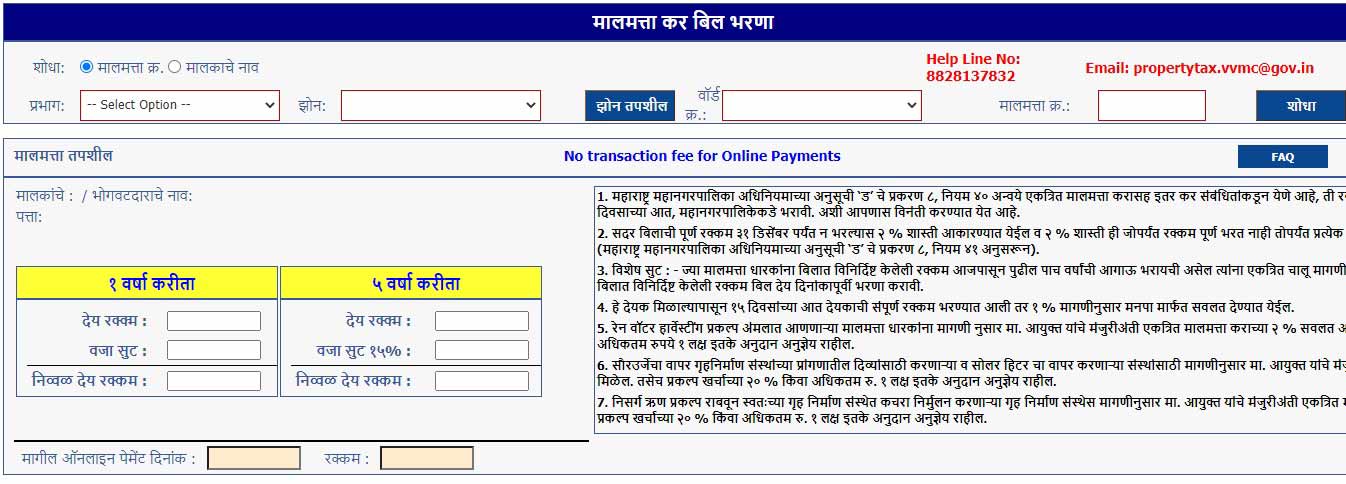

Taxpayers can check their property tax amount online. Just visit the online portal of www.vvcmc.in for online property tax payments. From there you can check the levy amount anytime in the comfort of your home. Follow the below-mentioned step-by-step instructions and get to know your property tax in Vasai-Virar -

- Visit the VVMC online portal

- Scroll down and click the Property Tax section

- Now, select the option of Online Payment

- Then, fill in the details like ward no, area, zone, etc.

- After entering all the details, the page will show the property tax amount.

- From here you can verify the tax amount

In case of any issue or discrepancy, you can always contact the authority. The helpline number is flashing on the page where you fill in the property details. So, for any assistance, you can contact them in the following ways-

Help Line No: 8828137832

Email: propertytax.vvmc@gov.in

Offline Process

Alternative method if online isn't available, You can always visit the VVMC office if you are not comfortable with the online tax payment process. But don't forget to carry necessary documents like the previous year's property tax receipt, assessment number, Photo ID, and other property-related documents. The office is located opposite to the Virar Police Station.

Address: -

Opp. Virar Police Station, Bazaar ward, Virar East, Maharashtra 401305

Contact Information

- The toll-free number for VVCMC:- 18002334353

- Contact Number for head office (landline):- 0250-2525105

- Contact Number For Disaster management (landline): -0250-2334546 / 0250-2334547

- Additional Contact Number of Disaster Management:- 7058911125 / 7058991430 / 8446427643

Vasai Virar Property Tax Late Payment Penalties

The last date for the payment of property tax 2024 is 31 December. Those paying within 3 months after that are making payment in the grace period. But After 31st March, the defaulters need to pay a penalty of 2% per month on the outstanding amount.

Now, let's understand this with the help of a table

| Payment date |

Penalty |

Rebate |

| Made before 31st Dec |

NA |

1% of tax amt |

| Made after 31st dec but before 31st march |

No penalty |

No rebate |

| Made after 31st March |

2% of outstanding amount per month |

NA |

| Made within 15 days of bill generation for 5 consecutive years |

NA |

15% of tax amount |

So peeps, set reminders for the relevant dates and make the most out of it. As the payment has to be done mandatorily then why not pay it on time to fetch the benefits of rebates. Its highly recommended to stay away from the burden of penalties for late payment. Keep a check on the latest updates by visiting the official Vasai-Virar City Municipal Corporation property tax payment portal. Moreover, if you have set your property on rent, don't forget to pay the GST on rental income along with the Vasai Virar property tax payment.

People Also Asked About VVCMC Property Tax

Q: What is the difference between property tax and house tax?

Property tax includes all sorts of buildings like residential, commercial, industrial, and vacant lands. Whereas house tax is a specific term used for the tax on residential buildings only.

Q: How can I download my VVMC property tax bill?

Follow the below-mentioned steps for downloading VVMC property tax bill-

- Visit the official portal

- Select the tab of Property Tax and then opt for Online Payment.

- Then, enter the details like ward number, zone, etc. to fetch the property tax amount.

- As the page displays the tax liability, you can download and print the screen.

Q: Can I pay VVCMC property tax in installments?

VVCMC might offer the property owner to pay the tax in installments depending on the case. For further information and clarity, it is better to contact the governing body.

Q: How can I find my assessment number for VVMC property tax?

To find the Assessment number, kindly check the previous tax bills or fill in the property details on Property Tax Details, to find the current bill with the assessment number.

Q: What is the due date for paying VVMC property tax?

The due date for paying the VVMC property tax is 31st Dec. If the amount is paid on or before this date, the taxpayers can claim the rebate. But if it is paid after 31st March, then they are liable to face late payment charges

Q: Is there any rebate for early payment of property tax in Vasai-Virar?

Yes. The property owners can enjoy a 1% rebate on the tax amount if the payment is made before 31st December.

Q: Are there any exemptions available for VVCMC property tax?

Yes. Government buildings, buildings used for worship and charitable purposes, agricultural land, and clean land are exempt from Vasai-Virar City Municipal Corporation property tax

Q: What is the difference between Ghar Patti and property tax?

Ghar Patti is the Marathi term used for denoting house tax. Whereas property tax is a broader term used for denoting tax on all types of properties including residential, commercial, and industrial.

Additional Resources

Useful Links-

Conclusion

Well, issues related to property tax can be complex. Better stay updated by checking the latest amendments in Virar Municipal Corporation Property tax. The simple formula to have clean records in the eyes of the authority is to timely pay the property tax. This avoids the late payment charges and benefits the residents in several ways. The governing body provides the online portal to pay VVMC property tax online. This adds to the convenience of property owners. So, pay online and on time to fetch the maximum benefits.

ADD COMMENT