What is Panvel Property Tax?

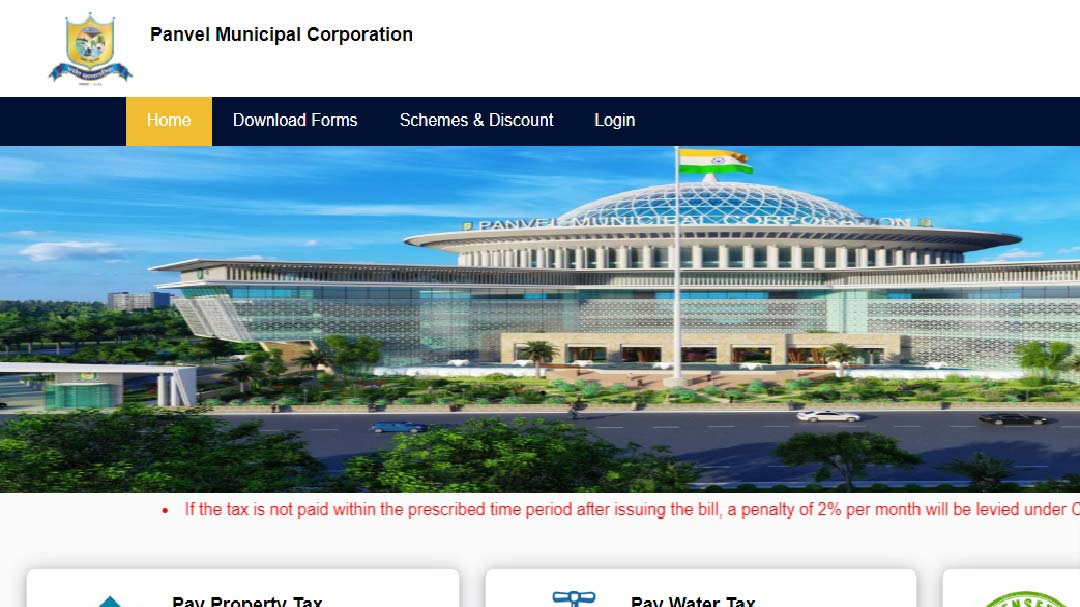

"The Panvel Property tax is collected by the Panvel Municipal Corporation (PMC) for funding the civic amenities and infrastructural development of the city".

This is a charge to be paid by the property owners in Panvel. The Municipal authority collects it from the owners of residential, commercial, and industrial properties falling under the city limits. So, the revenue earned out of this tax collection is ultimately used to benefit the residents by making the city a better place to live.

Briefly, CIDCO (City and Industrial Development Corporation) and Panvel Municipal Corporation are responsible for the development and maintenance of the city.

Let's know the PMC and CIDCO's responsibilities-

- Role of CIDCO- The latest developments in the city are happening in the New Panvel, which is under the administration of CIDCO. This authority is responsible for developmental projects including a plan of the city's layout, roadway system, population control, land development, etc. CIDCO was formed in 1970 and till 2016, the residents were supposed to pay tax to this authority only.

- Role of PMC- This authority was formed in 2016. After October 2016, New Panvel was also brought under the administration of PMC. PMC is majorly responsible for the regular operations and maintenance of the city including, drainage system, and other essential services.

CIDCO builds the system and PMC maintains it. For example, the water supply system in a particular area is built by CIDCO, it is handed over to PMC for regular upkeep.

Let's summarize the difference between the roles and responsibilities of CIDCO and PMC

| Aspects of Difference |

CIDCO |

PMC |

| Focus |

Development |

Management and maintenance |

| Year of formation |

1970 |

2016 |

| Development |

It acquires and develops new areas |

Manages the civic and other amenities of the areas developed by CIDCO |

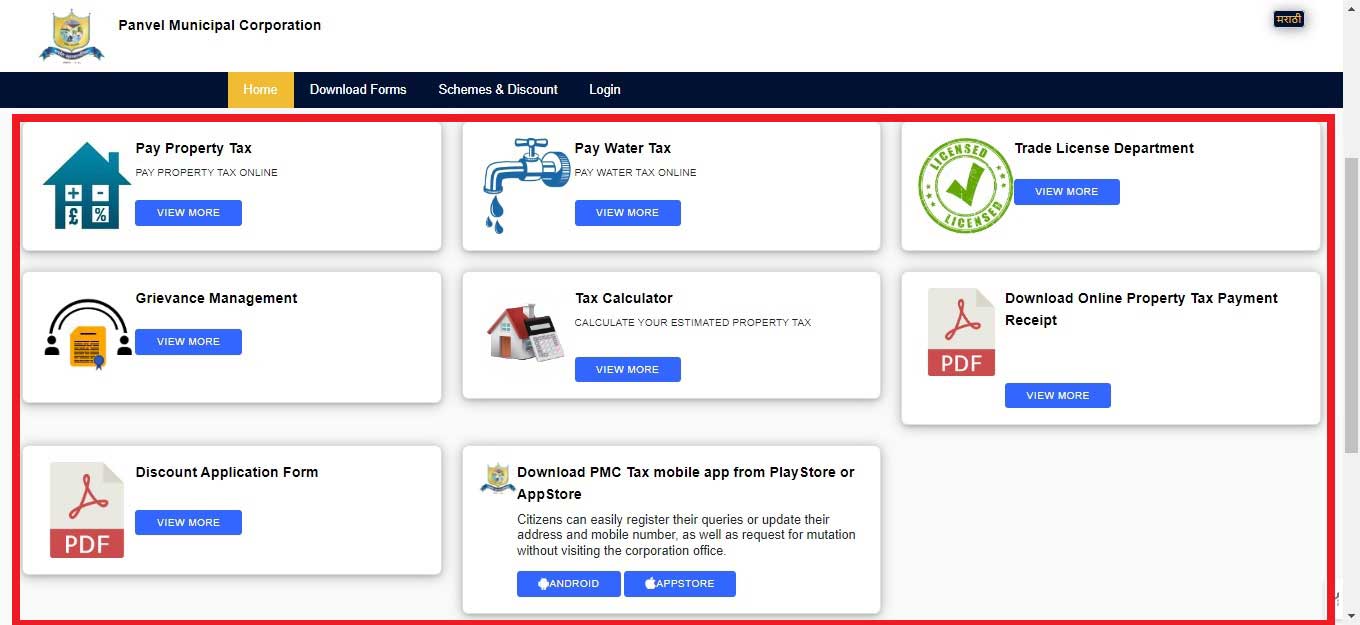

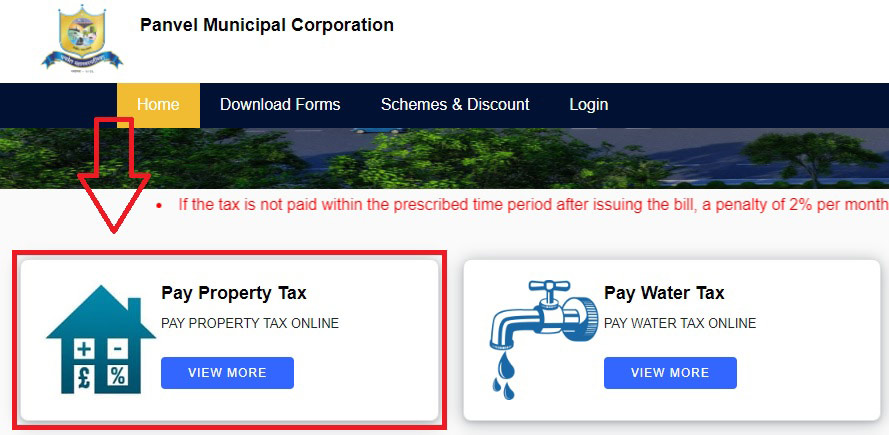

Services Offered On Panvel Municipal Corporation Portal

The official website of PMC offers a myriad of services that the residents can use for their utmost convenience. The user-friendly website is adept in assisting the residents with many areas to be dealt with. So, just navigate to the official Panvel panel and take advantage of the following services-

- Online payment of property tax

- Water tax payment

- Trade License Services

- Tax Calculator

- Grievance Management and Redressal

- Facility to download online property tax payment receipt

- Submission of Discount Application Form

The portal even serves as a medium to provide the latest updates and amendments to the taxation rules. So, keep checking it out and stay updated.

Panvel Property Tax Rates

PMC sets varied tax rates for different properties based on their location and type. Commercial properties have a higher tax rate as compared to residential properties. It is always better to refer to the previous tax bill or assessment notice to know the tax rate applicable to your property.

To get a clear picture of the rate of tax, reach out to the Panvel Municipal Corporation tax authority via mail and phone.

Factors Affecting Panvel Property Tax Calculation

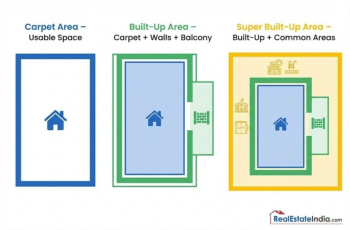

Several factors like property type, age of the property, build-up area, and base cost, affect the Panvel property tax calculation. The PMC thoroughly considers all of them and concludes by determining the correct charge. So, property tax in Panvel is calculated after understanding the above-mentioned factors for the property in question.

How to Calculate Panvel Property Tax?

A taxpayer has the option to calculate property tax automatically on the official portal.

Here, just fill in the details related to the property. After that, an OTP will be generated. As you verify the same, the website calculator will display your liability.

Or

You can use the below-mentioned formula for self-assessment and Panvel Property tax calculation.

Property tax= Base value* build-up area* floor factor * age factor * tax rate as per the type and location of property

Here,

- Base value is the assessed value of the property based on its type and location

- The build-up area is the constructed area of the property

- Floor factor depicts the floor assigned to the property

- Age factor denotes the property age

Let's get more clarity with the aid of an example-

Property tax= (Rs.150 per sq ft * 1200 sq ft* 1 0.7) * 28%

Amt Rs 35280.

Well, in the case of fractional ownership, the property owners are liable to pay the charge according to the share owned by each of them.

Who Needs to Pay Panvel Property Tax?

Anyone who owns any type of property in the city is eligible to pay the property tax per year. This tax is similar to the BBMP property tax in Bangalore, MCC property tax in Mysore, Nagpur property tax, Aurangabad property tax, and others. Well, this applies to the owners of the following property types-

- Residential included houses, villas, apartments, etc.

- Commercials including shops, offices, hotels, etc.

- Industrial including factories, warehouses, etc.

- Vacant Lands that are not built upon

For further clarification, you can contact Panvel property tax helpline number 1800-5320-340 from Monday to Friday, 10 AM to 6 PM. You can also send an email to panvelcorp.helpdesk@gmail.com

How to Pay Panvel Property Tax Online and Offline?

The taxpayers have the option to pay the property tax online and offline. Let's check out how both these options work.

Online Panvel Tax Payment

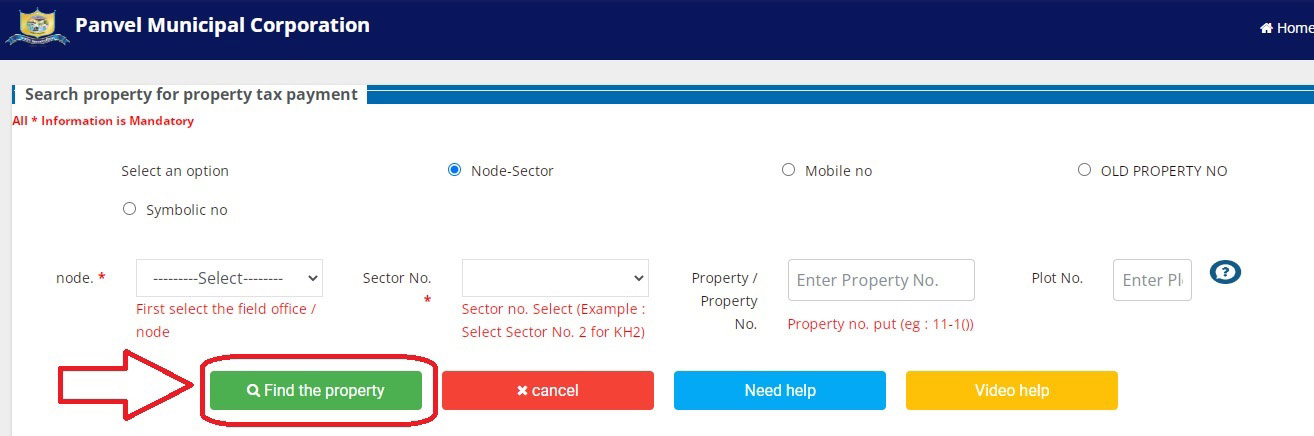

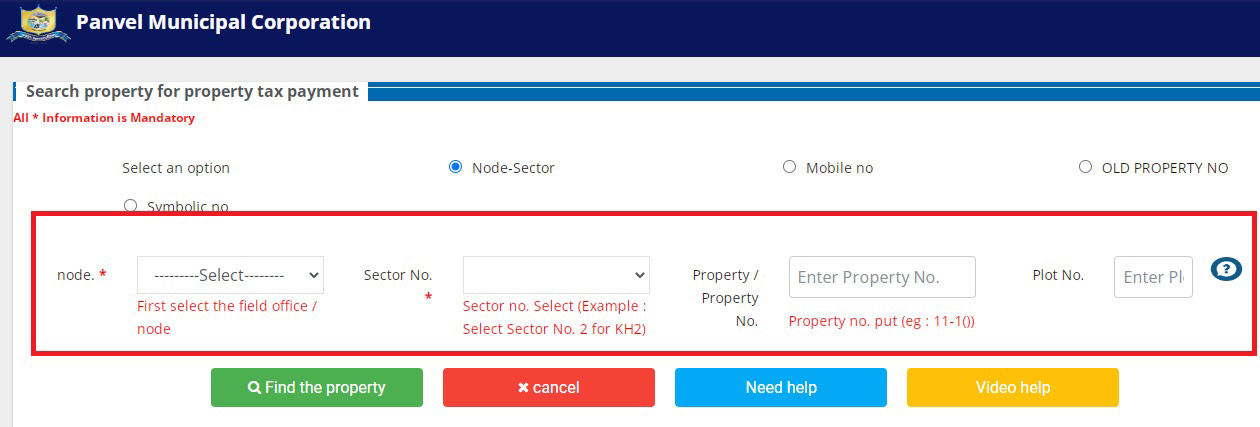

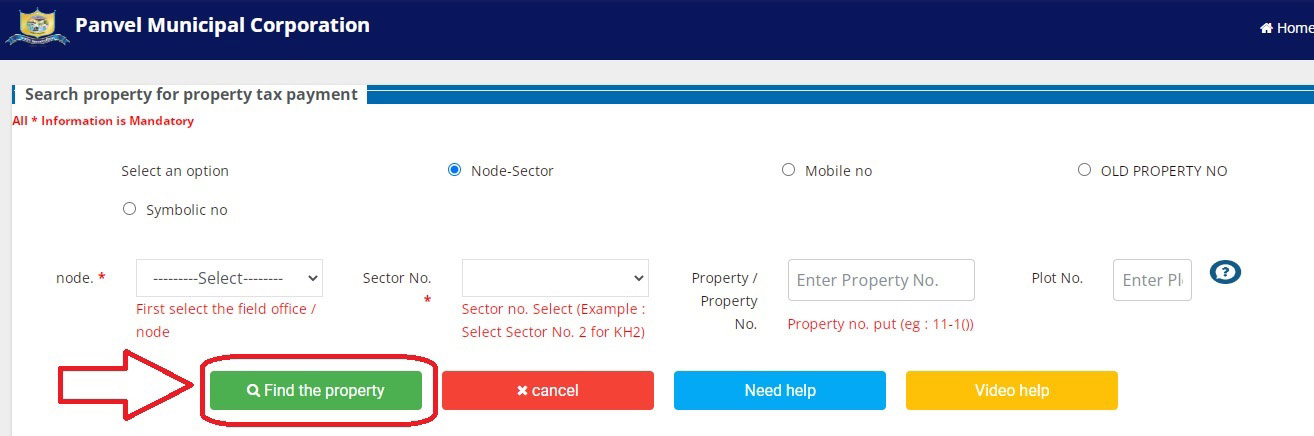

The user-friendly online portal of Panvel Municipal Corporation allows taxpayers to pay property tax online in a hassle-free way. Keep the property-related details, property tax bill, photo ID, etc. handy to pay your Panvel tax payments online. Let's check out the step-by-step process of how to pay Panvel Municipal Corporation Property tax online-

- Click on the option of 'Pay Property Tax Online'

- Now enter your property details like, Node number, Property number, sector number, etc.

- Now, click on 'Search Property' to get your property details

- Click on proceed after verifying the same.

- After verifying all the details like rates, etc. click on the Pay option

- Then, the amount due will be displayed in the section below. Press the button 'Proceed to Pay' to make an online payment.

- Enter your email ID and mobile number. Then click 'Pay Now'.

- Then you will be redirected to make property tax payments via different payment options like net banking, credit card, etc. You can choose the suitable payment gateway

- Complete the payment and click on the option of 'Get Receipt'.

- From the online portal, you can download it also for future reference

The online payment of property tax is now made more accessible by the Corporation office. So, pay property tax bills online in the comfort of your home.

Offline Panvel Tax Payment Methods

The Mahanagar also allows for offline payment. The owners can pay their property tax dues offline in the following manner-

The taxpayer needs to visit the PMC office with the required documents like previous tax receipts, photo ID, etc., and get the challan generated. The challan carries the property tax dues details. The payment can be made via Demand Draft or Cash at the PMC office or the designated bank branches.

However, if the property owner has rented out the property partially or fully, then he/she is also liable to pay GST on Rental Income

PMC Due Dates and Penalties

The due date for the payment of Panvel property tax in the current year is 29th June 2024.

Well, there is a relief for the defaulters as per the latest news.

According to the interim orders of the Supreme Court, the property owners need to pay dues only from the assessment year 2021-2022 onwards. So, it is mandatory to pay the due taxes from 1st April 2021 to 31st March 2024 by 29th June 2024. And for the outstanding between 2016 (the year in which PMC was formed) and 2021, a court case is pending for the settlement. As of this June, the property tax defaulters from FY 2016 -2021 are not obligated to pay the liability of this tax.

Late Payment Penalties and Fines

Panvel property tax bills must be cleared as per the property tax regulation else there is a penalty of 2% per month on the outstanding amount. So, be on time and avoid penalties for late payment of property tax in Panvel. Well, if the amount pertains to the assessment year 2016-2021, the imposition of penalty will be subject to the interim order still awaited.

Panvel Property Tax Exemptions and Rebates

The PMC has set guidelines for exemptions and rebates. These rewards help give an edge to those in need and those who put effort into being truly responsible citizens of the city.

Property Tax Exemptions

As per Times of India, there is one exemption from property tax section in Panvel-

Ex-Servicemen- The Palika offers a complete exemption of property tax for ex-servicemen and their widows residing within the vicinity of Panvel. So, being an ex-serviceman holds the eligibility criteria for exemption from Panvel Municipal Corporation property tax payment.

Rebates and Discounts

- Rebate for early payment- The early birds will surely gain from the PMC with the Panvel Property tax rebate. The corporation offers a rebate of 5% on the tax liability of the current year if full payment is made within 30 days of issuance of the tax bill.

- Online payment discount- If you make a bill payment online, you get a discount of 2%. So, don't miss the opportunity offered by the PMC and pay Panvel Property tax online.

- Senior citizen concession- The Municipal authority offers a senior citizen concession on the property tax amount. It's better to check with PMC to know the concession applicable to your case.

- Solar-Powered Projects- The Mahanagar Palika offers a 2% concession on the levy amount if you have installed a solar power system on your property.

- Rainwater Harvesting Projects- If you have a system for rainwater harvesting at your property, then you are eligible for a concession of 2% on the property tax amount.

Moreover, as per Pmc: Times of India, the property tax defaulters in PMC area are being offered yet another opportunity to clear the dues till September 30th. PMC has allowed the taxpayers to pay the outstanding amounts with a rebate of 50% on the penalty for delayed payment.

Here we summarize the section on due dates, penalties, and discounts with the help of a table.

| Description |

Penalty |

Discount |

| Late payment (after 29th June 2024) |

2% per month on the outstanding amount |

N.A. |

| Early payments (within 30 days of bill generation) |

N.A. |

5% rebate on current year's tax |

| Online payment |

|

2% concession on tax bill |

| Penalty amount paid before 30th September |

|

50 % rebate on the penalty amount |

| Green Buildings |

|

2% discount for solar powered and rainwater harvesting system equipped properties |

Panvel Municipal Corporation Customer Care

PMC website link- Panvel Municipal Corporation

Property tax Helpline- 022 2745 8040 / 41 / 42

Email id- panvelcorporation@gmail.com

FAQs About Panvel Property Tax

Question: When is the property tax due date in Panvel?

Answer: 29th June 2024 is the due date to pay Panvel property tax. So, hurry up guys, the date is approaching.

Question: Where can I find the Panvel property tax helpline number?

Answer: You can find the helpline number on the Panvel property tax portal home page flashing at the top of the screen in red letters.

Question: Where can I find my property tax bill?

Answer: You can find the property tax bill on the official website of PMC. When you proceed to pay the tax by following the above-mentioned guidelines in the section of 'How to pay property tax online', a page showing the tax bill will be generated before proceeding with the payment.

Question: What documents are required for property tax payment in Panvel?

Answer: Property bill, assessment notice, Photo ID, and other property-related details are required to pay your property tax

Conclusion

So, here we can conclude that though the responsibility of Panvel property tax payment falls on the shoulders of property owners, the revenue collected by the PMC is used for the city's betterment. It is always recommended to pay it online before the due date to reap the maximum benefits and avoid penalties. All you need to do is abide by the rules and regulations laid down by the PMC and stay updated on the latest amendments by checking its official website.

ADD COMMENT