Property tax contributes a large portion of the budget allocated to provide civic amenities in any city. Thus, responsible citizens ought to pay their property tax on time. In Mumbai, the responsibility of collecting this tax falls on the shoulders of the municipal authority, known as MCGM or BMC. As the richest civic body in India, it has collected a whopping Rs. 4,856 crores in 2023-24 alone. This has only been possible because lakhs of registered property owners in Mumbai choose to pay their MCGM property tax on time. In return, the government will use this money to maintain civic amenities and fund numerous public infrastructure projects. Thus, paying BMC property tax will ease their lives and propel the growth of this city.

As a Mumbaikar, hearing these facts, you may be motivated to pay your property tax in Mumbai before the due date. If so, this is your guidebook to get all the information about Mumbai property tax at your hand. To understand the information provided in this blog, you don’t need to be a financial wizard. Since we have explained everything in layman's terms, you will not find anything difficult to grasp. From the definition of the BMC tax to its calculation and payment, we have explained everything in detail. Hence, stay glued to this piece until you finish reading this.

What is MCGM Property Tax Or Brihanmumbai Mahanagar Palika Tax

MCGM is the abbreviation used for Municipal Corporation of Greater Mumbai. It is the name of the governing civic body of Mumbai city in the Maharashtra state of India. As a civic body of Mumbai, MCGM has the responsibility to collect property tax in this city. If you don’t know what property tax is, it is the tax levied on the land or real estate property owners. The civic bodies collect this tax for the local government in the area of their jurisdiction. By the same token, MCGM also collects the property tax in the Greater Mumbai area. This tax is popularly called MCGM property tax. Since MCGM is known as the Brihanmumbai Municipal Corporation (BMC), people also called it “BMC Property Tax” or “Brihanmumbai Mahanagar Palika Tax”.

Key Details: MCGM Property Tax 2024-25

| Information |

Details |

| TAX Name |

MCGM Property Tax or BMC Property Tax |

| Collected by |

Municipal Corporation of Greater Mumbai |

| Area of Jurisdiction |

Mumbai Metropolitan Area (MMR) |

| Who is Eligible to Pay |

Whoever own a real estate, shop, land or rental property in Mumbai |

| Payment options |

Both online and offline |

| Due Date |

30th June,2025 (subject to change) |

| Late Fees |

Penalty rate is 2% of tax amount |

How to Calculate MCGM Property TAX

To pay the mcgm property tax online or offline, first you need to confirm the total amount you will have to pay. It will give surety that you are paying the right amount. However, it raises questions like how to calculate it? Or can anyone do it? Well, you definitely do not need to be a CA to do this. Any ordinary person with basic calculation skills can do it on his/her own. They just need to know the process of doing it. Now, let’s know what goes in calculating the MCGM property tax.

How is it Calculated?

Quite opposite of SDMC property tax that is calculated using the “unit-Area System”, MCGM property tax is calculated on the basis of the capital value system. In this tax calculation system, the market value of the property plays a central role. However, other parameters like location of the property, property type, and floor space index (FSI), etc are also used to estimate the property tax in Mumbai. Taking these factors and property’s market value into consideration, BMC creates your property tax bill.

The formula to calculate MCGM Property Tax look like this: -

| Liable Tax Amount |

= |

Tax Rate * Capital Value |

Municipal corporations decide the tax rate each year which is currently 0.02% for residential properties in Mumbai. Besides, capital value depends on the market value of the property. And property’s market value itself is based on the ready reckoner(RR). It is the state government who sets the value of RR on the yearly basis and the revenue department uses it to calculate stamp duty. Apart from the RR, BMC also factors in other factors that we have discussed before to calculate capital value. The exact formula to estimate it is:

Capital Value= Market Value of the property (RR Value) * User Category*Type of Building *Age of the Building*Floor Factor*Carpet Area.

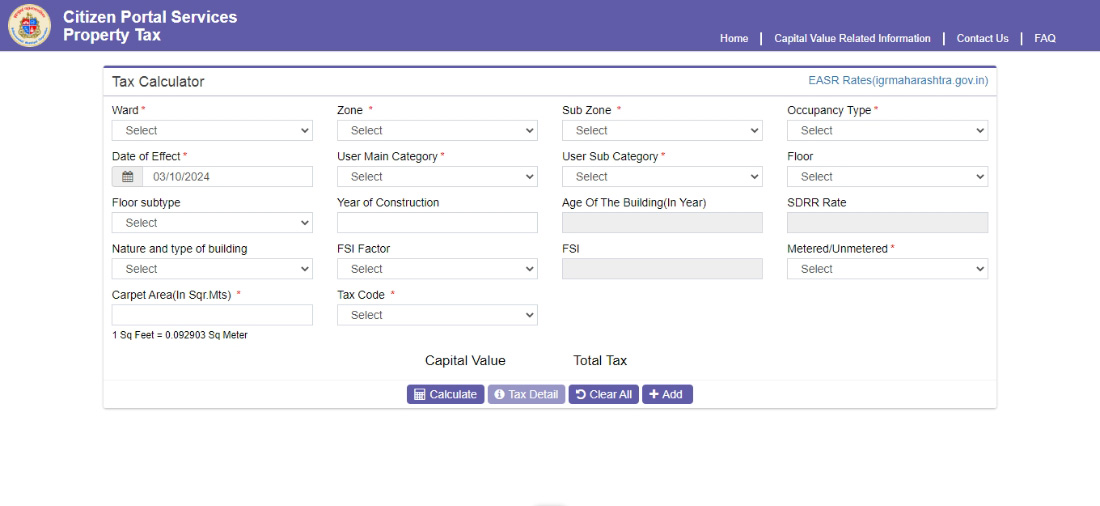

How to Calculate MCGM Property Tax Online

Since MCGM provides a property tax calculator on its web portal, this calculation is just a three-step process. Here are those steps to follow to use this online calculator: -

- Step 1: Open the calculator page on the MCGM’s official website

- Step 2: Here provide the details needed to calculate the amount of your property tax and other required details. Generally, the information you have to provide are ward number, nature and type of property, user category, tax code, carpet area, construction year, FSI factor, sub zone, floor and user sub-category etc.

- Step 3: Now, click on the “calculate” to see the payable tax amount.

MCGM Property Tax Exemptions and Rebates in Mumbai

Before bill payment of tax to municipal corporations in Mumbai, you must learn if you are eligible for tax exemptions. Yes, it is so because they offer tax relief if you are eligible for it. However, only finding out that you are eligible for it is not enough. You should also know how to apply for this. In this section, we will discuss exactly these two things. Read it to understand if you are exempt from tax payment.

Eligibility Criteria for MCGM Property Tax Exemption or Rebate

- If your flats or apartments in Mumbai cover less than 500 sq. feet of carpet area, you are not obliged to pay this tax.

- You can get a 60% rebate if the area of your property is between 500 sq. feet to 700 sq. feet.

- Taxes of properties used for public purposes like temples or charity trusts are also waived off.

How to Apply for a MCGM Property Tax Exemption Or Rebate?

Follow these stepwise processes to apply for property tax exemption or rebates if your eligible for it: -

- Collect all the documents that can help you to prove that you are eligible to tax exemption.

- With those documents, go to your MCGM local ward office and fill the exemption application form.

- Now fill this form with your undivided attention and verify the details.

- After verifying, attach all the photocopies of documents you have brought with yourself with the filled form.

- In the end, receive the application acknowledgment receipt and keep it carefully for doing follow-ups.

- If MCGM approves your application, you will get an official exemption certificate. Later, you can use this certificate to get an exemption in property tax.

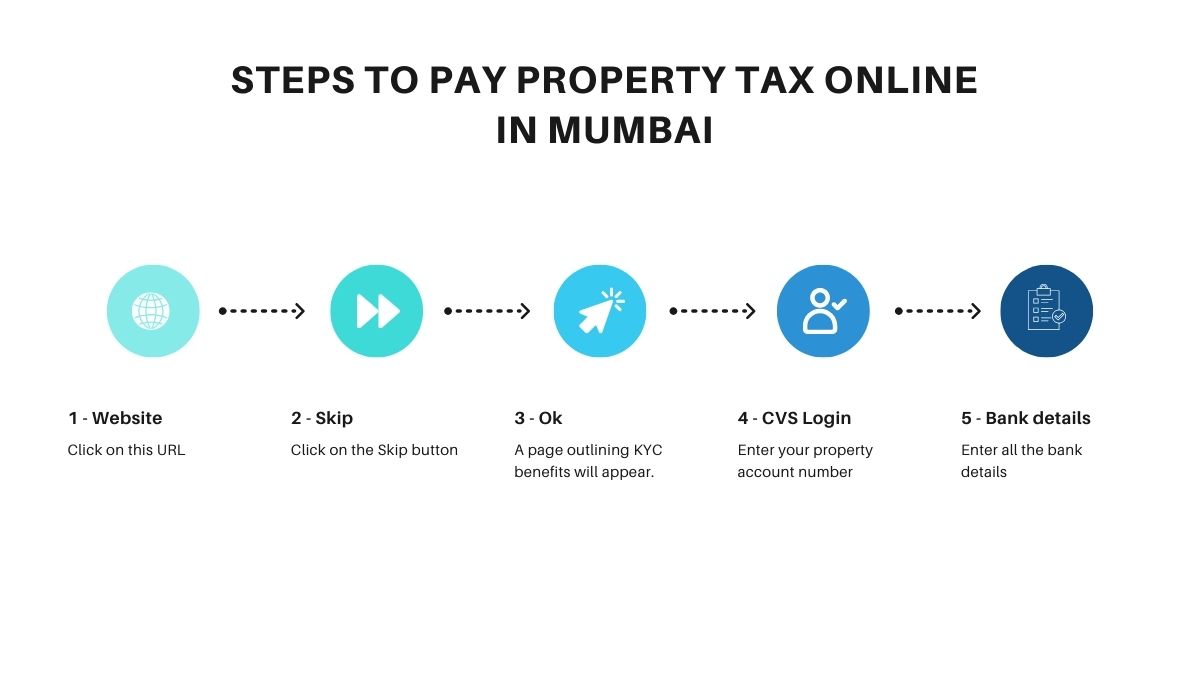

Steps to Pay Property Tax Online in Mumbai

Digital payment has revolutionized the money transaction in India. And property tax payment is not untouched by it. Indians now have no need to queue in long lines and do tedious paperwork to pay their property tax. Through a digital payment system, they can pay it online from the comfort of their home. Like almost every civic body in India, MCGM or BMC also give the multiple payment options for property tax bill online payment. If your property tax is not paid yet due to lack of time, do it online from wherever you are currently. Here are the steps to pay MCGM property tax online: -

- Step 1: Click on this URL:

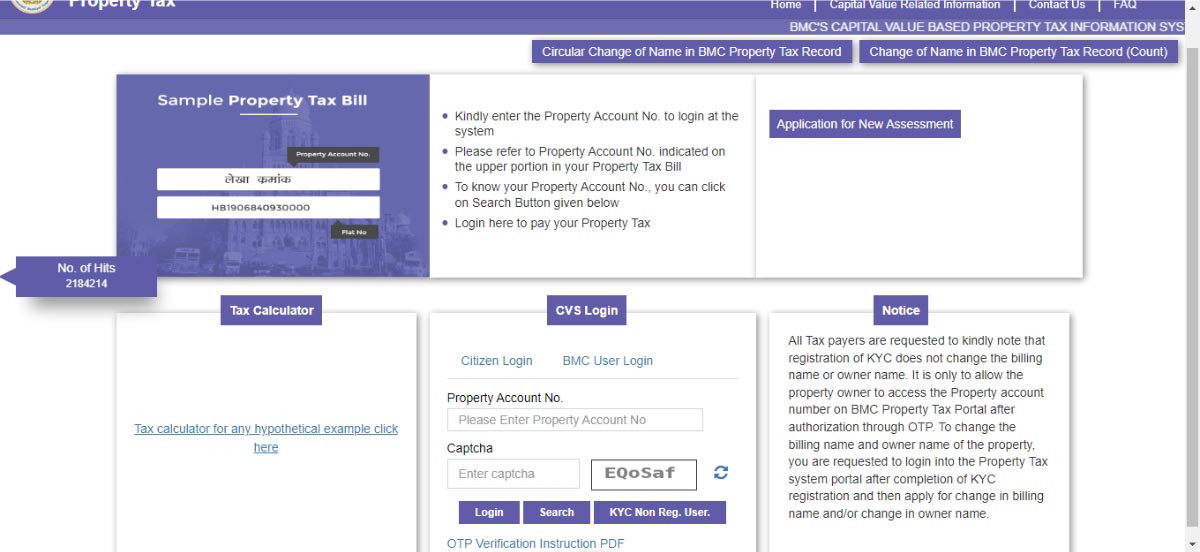

- Step 2: Now you have a Page with a “Skip” butter at the bottom. Click on this button.

- Step 3: A page informing about the benefits of KYC will appear. Click on the “Ok” button present at the bottom of the screen.

- Step 4: Now, You will have a section titled as “CVS Login” at the bottom center of the page. Enter your property account number and fill the captcha in this section. Double-check the entered detail and click on the “Login”.

- Step 5: New page will show your outstanding bill. Thus scroll down and enter the amount you want to pay and select the bank you want to pay through.

- Step 6: Enter all the bank details required to pay the bill.

- Step 7: Download the receipt.

Process of Paying MCGM Property Tax Offline Payment

The process to pay the property tax to the municipal corporation in Mumbai via an offline method is somewhat very simple. For this, first you have to visit at any BMC Help Centre or the Office of the Revenue Officers or at a Citizen Facilitation Centre. Since these centers operate in all wards of Mumbai, you can easily find one in your ward. At that center, ask the front desk officer about the procedure to pay the tax. After that, take the tax payment form from him and fill your property details and attach the required documents. Now, double-check to ensure you have given the correct details in the form and submit it. In the end, pay the tax you are liable to as per the rule. To pay this tax, you have plenty of payment options to choose from like debit card, credit card, UPI, and net banking. After getting confirmation of the payment of property tax, ask for the receipt. Once you have it, keep it as the proof of the payment.

People Also Asked About MCGM Property Tax

Question 1: How can I download receipts of MCGM property tax paid in previous years?

You can download the previous years property tax receipts online from the official website of MCGM. Visit on this page and login by entering your property account and number and filling the captcha. After login successfully, you will find the section “Print Receipt”. Click on it to move to the next page. Now, you will see a list of all your MCGM property tax receipts with the latest one at the top. Scroll down to the receipt you want to download and click on the print receipt.

Question 2: What should I do if my property tax bill is incorrect?

If you have any error in your tax bill, you need to take quick action regarding this. First thing that you must do is collect all the documents to prove there are mistakes in your property tax bill. After this, go to the MCGM and file a formal complaint of these mistakes. Only filing a formal complaint is not enough, show them the evidence you have garnered to prove the mistakes in your bill.

Question 3: What happens if I miss the MCGM property tax payment deadline?

Missing the due date of paying MCGM property tax results in a penalty of 2% of the payable tax amount. It is not a one time penalty but a monthly one. For each missed month, this fine will be levied on you.

Question 4: How can I get my MCGM property tax bill by email?

To receive your MCGM property bill by email, you need to complete your KYC on BMC’s online portal. For this first visit “portal.mcgm.gov.in”. On this webpage, you will see “Online Service” on the top menu bar. On clicking on it, multiple options will appear. You need to select “Pay Property Tax”. Now, you will see a page with many pointers. First read it and then click on “Skip”. After this, you will get a page asking you to do KYC. Click on the “OK”. Next, enter your property account number, fill the captcha, and click on the “Login”. Here enter all the primary details and save it. Now, your KYC is complete. You will see a pop up on screen notifying that from now onwards you will get alerts, bills and updates on mail.

Question 5: How to view my MCGM property tax bill online?

To view your MCGM property tax bill online visit the official website of MCGM. On this website, enter your property account number and fill the captcha to login your profile. After that you will be redirected to your account where you can see all your details including your property tax bill.

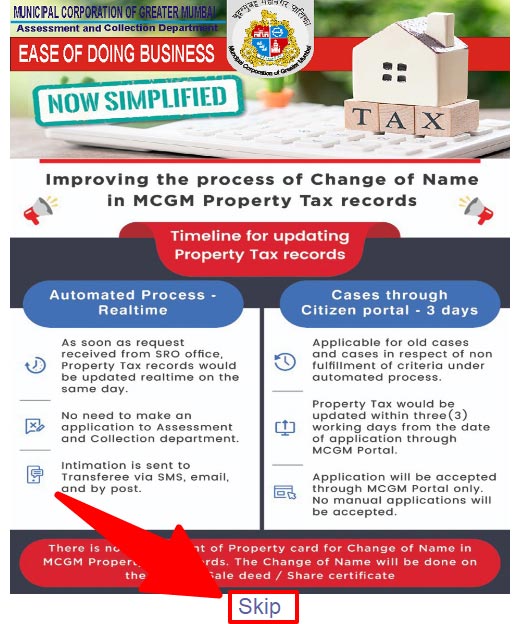

Question 6: How can I change my name in the MCGM property tax records?

Your name in MCGM property tax records is on the basis of share certificate or the sale deed. Thus, you can not change your name in your tax records alone. For this, first you have to change your name in the documents that you have provided. Using these updated documents, you can change your name in Mumbai property tax records. The process of changing name is free since MCGM doesn't charge any fees for it. After name change, you can view the details on the MCGM Portal.

ADD COMMENT