Do you own a property in South Delhi? If yes, you are liable to pay South Delhi Municipal Corporation Property Tax or SDMC Property Tax. This tax is collected by the MCD. The tax collected by the Municipal Board is then used for the maintenance and development of several amenities including, drainage system, sewerage, roads, healthcare, education, and much more. So, the property tax payment made by the property owners ultimately benefits them as the civic amenities are upgraded via this payment. Keep scrolling down to learn about SDMC property tax, how to pay it online / offline, due dates, penalties, and much more.

What is SDMC Property Tax?

Definition: SDMC property tax is imposed on property owners residing in South Delhi. It is levied by the South Delhi Municipal Corporation to fund the civic amenities like maintenance of roads, drainage systems, etc., and infrastructural development. It is a mandatory charge that must be paid on time to avoid undesirable penalties.

Based on the property location, the owners must pay property tax to the respective Municipal Authority. The residents of South Delhi must pay property tax to South Delhi Municipal Corporation and residents of North Delhi are subject to pay property tax to North Delhi Municipal Corporation. So, the MCD property tax or Delhi Property tax will be paid to SDMC for the properties located in South Delhi. The tax amount collected is used for the development and maintenance of the South Delhi area.

Latest News on SDMC Property Tax 2024

In May 2022, the different zonal corporations of Delhi like South, North, and East were combined to a unified authority of Municipal Corporation of Delhi. SDMC used to have an area of 253.63 sq mi which was further divided into 104 wards and Central, South, West, and Najafgarh Zone. But now MCD is a consolidated body. One can relate the mechanism of this tax with similar charges in other cities like BBMP property tax, Aurangabad property tax, Panvel property tax, VVMC property tax, and others.

In the quarter of April to June 2024, MCD collected Rs 1,400 crore in advance tax. This is quite more than the amount of 1148 crores collected last year during the respective quarter. Moreover, the number of taxpayers has also seen a rise in this period from 7,24,319 to 8,79,521 as compared to the last year. A big credit goes to the option of online payment being available to the taxpayers. This has provided ease and convenience in making timely payments.

How to Calculate SDMC Property Tax?

MCD divides Delhi into 8 categories from A to H. The property tax rates and property values are determined based on the category to which the property falls. Well, there are many other factors that influence property tax in Delhi.

Factors Affecting Property Tax

SDMC property tax is calculated by the authority based on several factors that influence tax rate and property value.

- Annual Rental Value- This is the estimated rental value that a property can fetch per year. This value is concluded based on the value of the unit area of the property, build-up area, age, and type of construction of the property.

- Property type and age- Different property types have different tax rates and valuations. Commercial properties are subject to a higher tax rate as compared to residential ones. The age of the property is also a major factor considered by the authority for tax computation

- Rebates and Exemptions- The Municipal authority offers rebates and exemptions to special cases like senior citizens, differently abled, early payers, etc. This affects the tax liability of the property owner towards the South Delhi property tax. Further in this article, we will bring more clarity to this section of MCD house tax. So, just read on guys.

Calculation of SDMC Property Tax

The formula for calculating the Property tax in Delhi is-

Property tax = Annual Rental Value or ARV* Tax rate

Here,

1. ARV is determined by taking into account the following

- Unit area value of the property, which is determined based on the category to which the property falls. Just scroll down and refer to the table mentioning UAV as per the property category.

- Structure factor- It is the value assigned based on materials used for constructing the property.

| Structure Type |

Structure factor |

| Pucca building, made using RCC or like materials |

1 |

| Semi-pucca, made using bricks, mud, etc |

1 |

| Kacha building, made using bamboo, stones, etc |

0.5 |

- Age Factor- It is the value assigned by the authority according to the year of construction

| Construction |

Age factor |

| Prior to 1960 |

0.5 |

| 1960-69 |

0.6 |

| 1970-79 |

0.7 |

| 1980-89 |

0.8 |

| 1990-99 |

0.9 |

| 2000 onwards |

1 |

- Use Factor- It is determined according to the purpose for which the property is used.

| Property type |

Use factor |

| Residential property |

1 |

| Non-residential public purpose |

1 |

| Non-residential public utility |

2 |

| Entertainment, clubs, etc |

3 |

| Restaurants and up to 2-star hotels |

4 |

| 3-star and above hotels, hoardings, and towers |

10 |

- Occupancy Factor- It is derived based on the status of occupancy of the property in question.

| Occupancy Type |

Occupancy factor |

| Self-occupied |

1 |

| Rented |

2 |

| Vacant plot |

0.6 |

2. Tax rate is the rate applicable to the property in question. It varies based on the property category from A to H. Here, we summarize the property tax rates in Delhi and unit area value according to the 8 categories dividing the city.

| Category |

Type of area that falls under the category |

Unit Area Value per sq meter (Rs.) |

Tax rate of residential property (%) |

Rate of Tax on commercial property (%) |

| A |

Luxury residential area like Vasant Vihar, Panchsheel Park, etc. |

630 |

12 |

20 |

| B |

Areas with premium amenities like Punjabi Bagh, Greater Kailash, Pamposh Enclave, etc |

500 |

12 |

30 |

| C |

Developed areas like East of Kailash, Green park, Saket, etc |

400 |

11 |

20 |

| D |

Prominent areas like Rajouri Garden, Karol Bagh, Anand Vihar, etc. |

320 |

11 |

20 |

| E |

Emerging and developing areas like Dwarka, Janakpuri, Chandni Chowk, etc |

270 |

11 |

20 |

| F |

Affordable areas like Bawana, Narela, Inderlok, etc |

230 |

7 |

20 |

| G |

Areas with limited facilities like Aya Nagar, Hari Nagar, etc |

200 |

7 |

20 |

| H |

Rural areas like Sultanpur, Madanpur Dabas, etc. |

100 |

7 |

20 |

Point to remember- If the property owner has let out the property on rent, then he/she must pay GST on rental income too. This is in addition to the payment of property tax to the respective authority.

To exactly know the colony and ward to which your property lies, check the info available on the official Municipal Corporation of Delhi website.

How to Pay SDMC Property Tax?

The payment of MCD property tax online and offline can be made by following a step-by-step process.

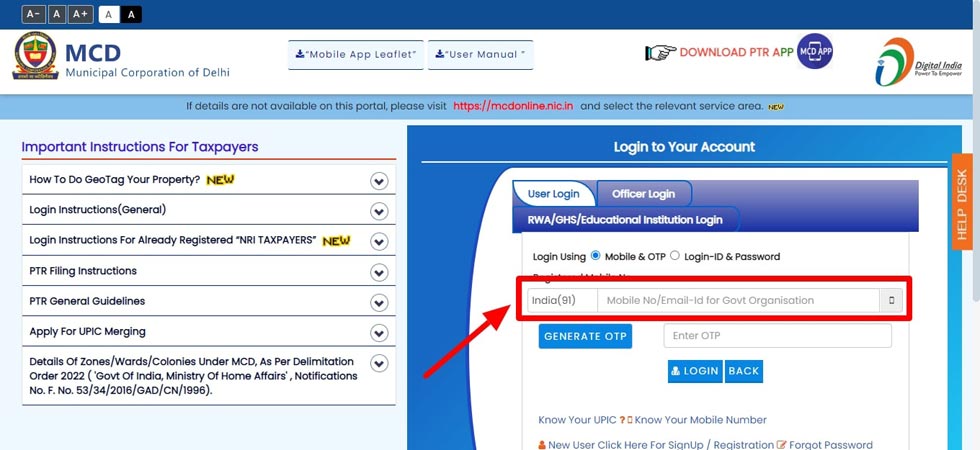

Online Payment Method

This method is highly convenient as it avoids long queues, and you can pay the property tax bill anytime in the comfort of your home. By following the below-mentioned steps, you can pay SDMC property tax online.

- Visit the official SDMC portal

- Click on the option of Pay Your Property Tax on the top of the right-hand side of the screen

- Enter your registered mobile number of click on Generate OTP

- On entering the OTP, kindly login to SDMC

- Then, Click on Search Property on UPIC

- Enter the property tax ID and other details like colony, owner's name, etc.

- After that, verify all the details and make the payment by clicking Pay Tax

- You can pay MCD property tax via credit card, net banking, and other options

- After the payment process is successful, download the property tax receipt of SDMC property tax payment online.

Offline Payment Method

You always have the option to pay property tax offline. Visit an ITZ cash counter, Custome Service Bureau Center or designated bank branches like HDFC and Axis Bank in person to pay the property tax amount. The payment can be made via cash or Demand Draft.

No matter how the payment is made, online or offline, it must be made on a timely basis to avoid charges and penalties. The payment of this tax is mandatory even if the owner is under the contract of Fractional Ownership. In such cases, tax is paid based on the property share of the owners. One major benefit of paying property tax on time is that it makes the property sale transaction a smooth process. So, if you have a property for sale or rent in Delhi, then clear the payment of MCD property tax in Delhi for an unrestricted transaction.

SDMC Property Tax Exemptions and Concessions

The Municipal Corporation offers exemptions and rebates to many. Check out the below list to find out if you are eligible for the same

Exemptions

- Agricultural Land

- Heritage buildings

- Buildings that are used for charitable and religious purposes.

- Properties owned by the winners of a gallantry award or international medal.

- Property owned and self-used by war widows or martyred law enforcement or paramilitary troops.

SDMC Property Tax Rebate

To encourage the property owners to make early and timely payments, the authority offers certain rebates. It even offers concessions to the elderly, differently abled, and women. Let's check out how much rebate is offered in different cases

- Early payment- If the payment is made on or before 30th June, MCD offers a 20% rebate on the total tax amount. But it must be paid in full. So, pay the Municipal Corporation of Delhi property tax before this date and enjoy the concession.

- Online Payment- Pay property tax online in Delhi and get a rebate of 2% or Rs 10,000 whichever is lower. So, pay on time and pay online to avail the maximum benefit.

- Senior Citizen Rebate- Senior citizens are eligible for a 30% rebate on the tax amount. But it applies only to one self-occupied property up to 200 sq meters. Property-related documents like Property ID, etc. must be presented to claim the rebate.

- Differently Abled- The Municipal Corporation offers a 30% rebate on tax amount if the property owner is differently abled. But the eligibility is the same as that of Senior Citizen Rebate.

- Rebate for Women- If the property owner of a residential property like a villa, etc. is a woman, then MCD provides a rebate of 30% on the tax amount. But the property must be self-occupied by the woman and the concession is up to 200 square meters.

- CGHS and DDA Flats- A concession of 10% on tax is provided to the owners of CGHS and DDA flats up to 100 sq meters.

The Process for Applying for SDMC Property Tax Exemptions & Rebates

The concessions available for online and early payment are automatically availed while making payment of MCD. And in other cases, like senior citizen women, etc. Photo ID and property ownership documents are required to be presented to the authority. This is because some verification is required to be done by the authority.

SDMC Property Tax Due Date and Penalty

The due date for paying tax on property in Delhi is 30th June of every financial year. Missing this deadline will not only spare you from the benefit of a rebate but will also attract a penalty. Payments made after this date are subject to a penalty of 1% every month of the outstanding amount.

Here we present a table for clarity on due dates, rebates, and late payment charges

| Date of payment |

Rebate |

Penalty |

| On or before 30th June |

20% rebate on tax amount |

N/A |

| After 30th June |

N/A |

1% per month on the outstanding amount |

Frequently Asked Question on SDMC Property Tax

Q1. What documents are required to pay SDMC property tax

Property ID and other related property details should be handy while making the payment of SDMC property tax offline or online. property ID can be found on your property tax receipts of previous year. If the rebate applies to you, then carry a Photo ID, age proof or disability certificate, and property ownership document for verification.

Q2. Can I pay SDMC property tax in installments?

Yes, you can always make payments in installments. MCD rules require the taxpayers to pay in full on or before 30th June. If any installment is paid after that, a late payment penalty will be imposed on that installment.

Q3. How can I get a duplicate SDMC property tax receipt?

Follow the below-mentioned steps to fetch a duplicate property tax receipt-

- Visit the official MCD portal and log in using the mobile OTP.

- Click on the section of Online Services on the top of the right-hand side of the screen

- Then, select the option of Old PTR View.

- This will then navigate you to the Property tax payment receipt.

Or, Visit the MCD office with the necessary documents and get the duplicate receipt generated.

Q4. What are the contact details for the SDMC property tax department?

- Address- Dr. S.P.M. Civic Centre, Minto Rd, SKD Basti, Press Enclave, Ajmeri Gate, New Delhi, Delhi, 110002

- Helpline Number (CCR): 155305

- Email Id: mcd-ithelpdesk@mcd.nic.in

Conclusion

So, here we can summarize that it is the responsibility of a property owner to pay SDMC property tax on time. Payment either made online or offline, makes the taxpayer a responsible citizen and helps in avoiding burdensome penalties. Stay updated about the latest amendments made by the Delhi government by checking the MCD official website. So, pay your South Delhi Municipal Corporation property tax and be a contributor to a better environment in South Delhi. This will help make it a better place for all.

ADD COMMENT