Do you own a property in the populous city of Mysore, Karnataka? But confused about how to pay Mysore Property Tax, Online or Offline? And what are the payment deadlines to avoid penalties? Phew! Isn't it troublesome? Well, here we clear all the confusion. Real Estate India provides you with a complete guide on this tricky matter of paying property tax in Mysore. So, let's get to know how the two authorities in Mysore, namely MCC and MUDA, handle the section of Property Tax and other related matters in the city.

What is Mysore Property Tax?

This levy is collected by the Mysore City Corporation (MCC) from the property owners. The revenue so collected is used for funding different amenities like sewerage systems, water supply, road maintenance, waste management, public transportation, parks, schools, healthcare, etc. So, ultimately the residents of the city get the benefit. The responsibilities of 2 authorities handling the property tax system in the city are as follows-

- Mysore City Corporation - This civic body is responsible for collecting property tax from the asset owners and maintaining the civic amenities. This authority is responsible for maintaining most of the city. So, be it health & hygiene infrastructural development or administrative functions, all are managed by the MCC.

- Mysore Urban Development Authority- MUDA develops the layout of the city and narrates how residential areas, roads, parks, entertainment areas, etc. will be sectioned throughout the city. After the layout development part is done, MUDA transfers the layout to MCC. Till the layout is not transferred to MCC, the property owners are liable to pay fees to MUDA. After the transfer, they have to pay regular taxes to MCC only.

So, just like Aurangabad property tax and BBMP tax, this charge is also the responsibility of the asset owner.

Mysuru City Corporation (MCC) vs Mysore Urban Development Authority (MUDA) Property Tax

| Basis of Difference |

MCC |

MUDA |

| Responsibility |

Civic and infrastructural development of the city |

Development of layout of the city |

| Applicable Area |

Within the city limits |

It focuses on developing layouts for Mysore city and its surrounding areas |

| Online payment portal link |

Online Payment (mysurucitycorporation.co.in) |

Online Payment |

| Contact information |

| Email |

itstaff_ulb_mysore@yahoo.com |

| Phone |

0821-2418800/2440890/2418816/2431112 |

|

| Email |

mudamysuruetax@gmail.com |

| Phone |

7406655006, 7406655007, 7406655008, 7406655009 |

|

The process of layout transfer from MUDA to MCC can sometimes be delayed. If you are not sure about whom to pay the tax, contact MUDA or MCC directly via mail or phone. Once the layout is transferred to MCC, the taxpayer is no longer liable to pay property tax to MUDA. Instead, regular taxes are then paid to the MCC.

Mysore City Corporation (MCC) Property Tax

The property tax in the city of Mysore is to be paid by the owners of residential and commercial buildings. This includes the buildings falling under the established areas within the city and areas in the outskirts that have been officially transferred by the MUDA to MCC. Now, let's check out how this property tax is paid online and offline.

How to Pay MCC Property Tax Online Using Karnataka One Portal?

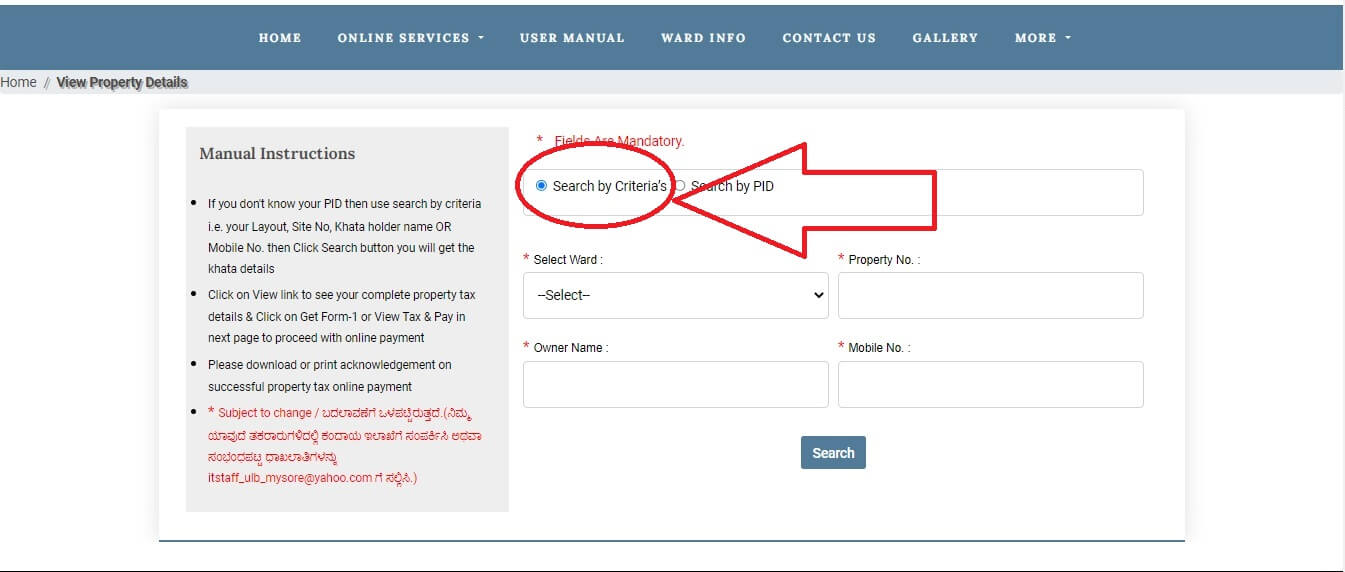

You can follow the below-mentioned steps to pay your Mysore property tax online through the property tax portal -

- Visit the official portal of Mysuru City Corporation.

- Click on the Property Details option and pay online under the Online Services section.

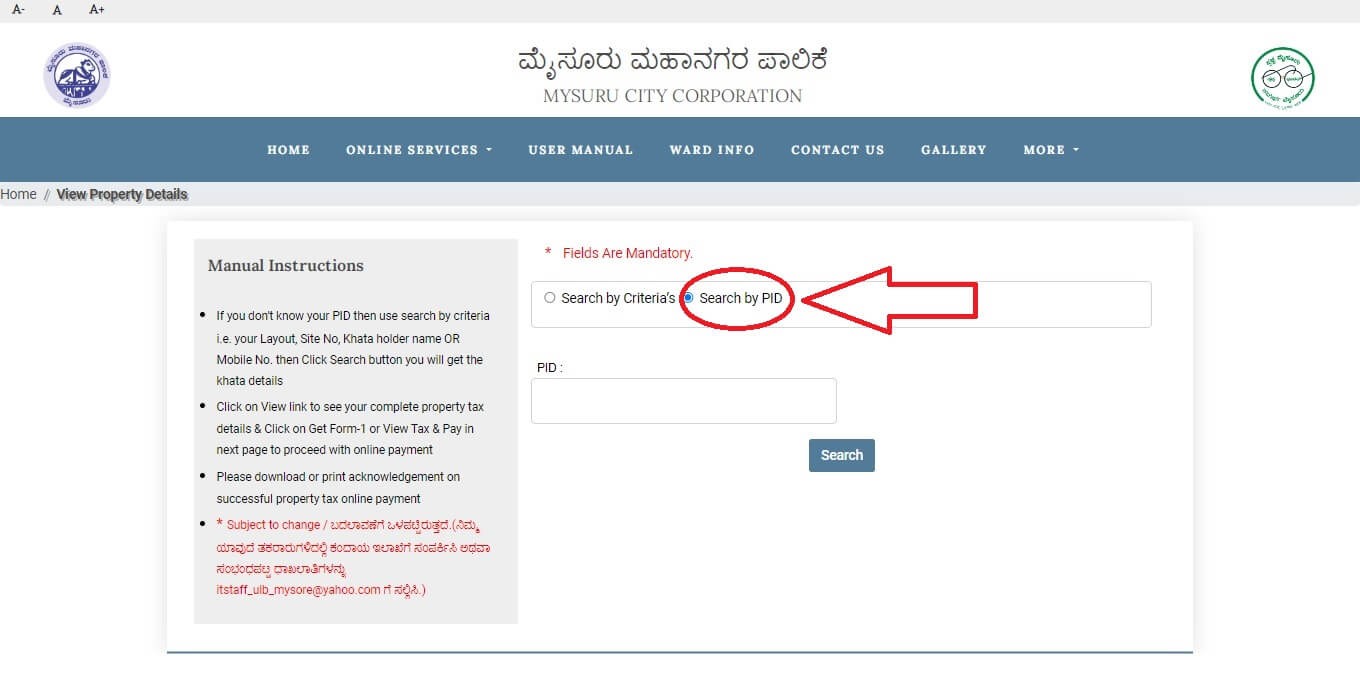

- Enter the 15-digit Property Identification Number (PID) if you don't have the PID number.

- Then select the option of Search by Criteria and fill in the info like war number, property number, owner's name, and mobile number.

- Click on the Search tab.

- The property details will appear with the total amount of property tax to be paid.

- Click on View Tax and Pay

- Then proceed with online payment by choosing any of the suitable payment methods like NEFT, Credit Card, Debit Card, etc.

- Download and Print the property tax receipt on a successful payment.

How to Pay MCC Property Tax Offline?

For offline payment, visit the designated zonal office or the main office, with the required documents like PID, credentials of the owner, and other property details. The staff working there will generate a challan containing the tax amount. You can then pay it via cash, cheque, or DD.

Tip to remember- Always check the respective zonal MCC office assigned for the area in which your property lies. This zonal office is meant to collect your MCC tax payment.

Mysuru Urban Development Authority (MUDA) Property Tax

MUDA acquires the land and allocates plots to the residents. Muda generally collects fees from the property owners and not the property tax. The property tax is collected only in the case when the layout is not yet transferred to the MCC. These are mostly new layouts getting developed in the outskirts of the city. So, till the layout is transferred to MCC, the owners are required to pay the fees to MUDA for the development and maintenance of the city.

How to Pay MUDA Property Tax Online?

Refer to the below-mentioned steps for a hassle-free payment of MUDA tax online

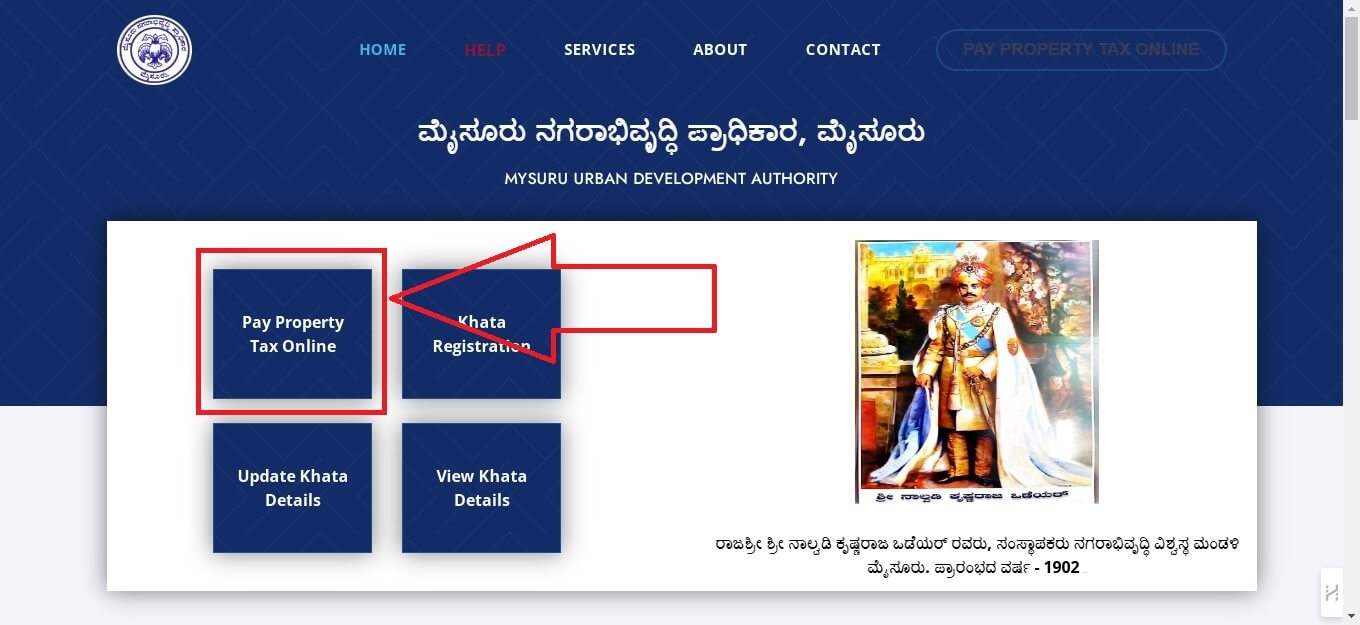

- Visit the MUDA official portal

- Click on the option of Pay Property Tax Online

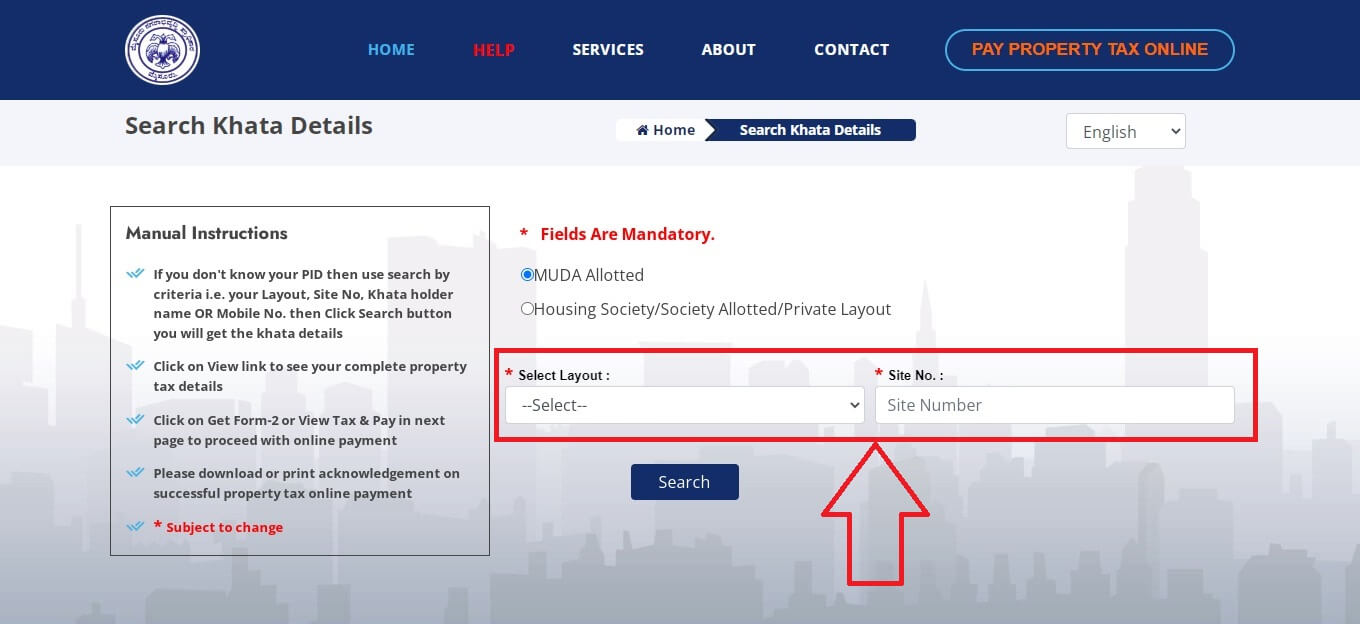

- Fill in the details like layout and site number.

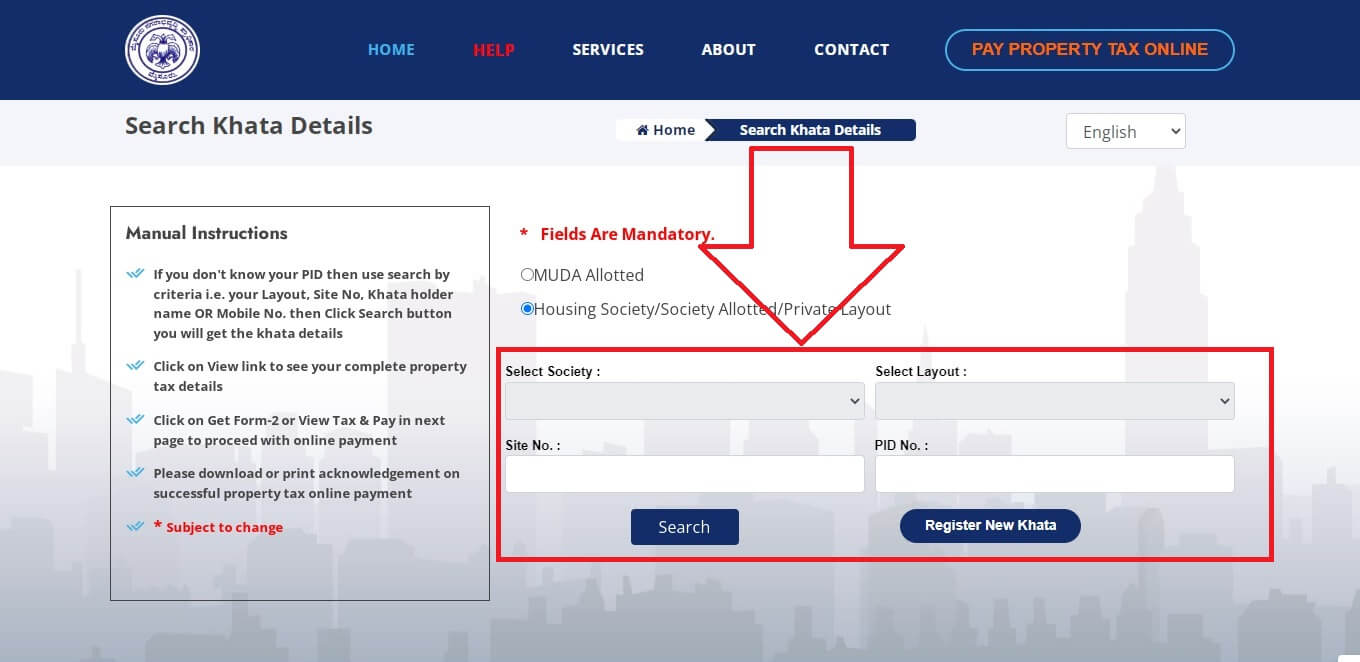

- The taxpayers can also select the option of Housing society/society allotted/private layout. Here you need to enter the PID number and site number after selecting the society and layout.

- Click on the Search button and get the Property tax amount in detail

- On the next page, the payment option will appear.

- Check the suitable payment method like IMPS, Credit Card, etc., and make payment.

- Don't forget to Download and Print the receipt.

How to Pay MUDA Property Tax Offline?

Assesses can pay their property tax offline too. Just visit the MCC zonal office with the necessary documents like PID, Photo ID, etc. The payment there can be made by cash, cheque, or DD upon generation of a challan. For any clarification regarding the amount, it's better to contact MUDA.

Important Dates and Rebates

- Due Date- After the Covid -19 pandemic the due date for the payment of Mysore property tax has been extended to 31st July of every financial year. In case of failure, the payer is liable for a 2% penalty every month.

- Rebate- Early birds are likely to receive a benefit of a 5% rebate on the tax amount. So, pay it before 31st July and enjoy the concession.

So, be a responsible citizen and make your contribution towards making this city a better place to live.

What are the Benefits of Paying Mysore Property Tax?

There is a mirage of paying the Mysuru property tax both for the city and the taxpayer. Some of them are listed below-

- City's Development- This tax is a major source of revenue to fund the public services and infrastructural development of the city. Public parks, schools, healthcare, drainage systems, roads, etc. are maintained and improved with the revenue so collected by the MCC.

- Compliance with the rules- Timely payment of property tax via the online portal makes you comply with the rules and regulations of the city. This avoids penalties too.

- Maintenance of property records- Completing the payments every year helps in maintaining the record of the property with the municipal authority. For example, if the records of a property for sale in Delhi, Mumbai, or any other city are properly maintained, then the sale transaction would be quite smooth.

How to Calculate Your Property Tax?

Property tax can be well calculated manually. There are two methods of tax calculation. All you need is the correct info about the property and put that into the below-mentioned formulas-

Property Tax = Built-up area X Age Factor X Base Value X Type of Building X Category of Use X floor factor

This can be better understood with an example of a residential property-

Property tax = 1300 sqft *0.8 *Rs. 40 per sqft

= 2 *3 * 0.5 = Rs 124800

Property tax = Annual Rental Value (ARV) × Applicable Tax Rate + Additional Charges.

Let's understand this with the help of values, for example

= 360000 * 6% + 3000

= Rs. 24600

*If the property is rented by the owner, then apart from Mysore property tax, GST on rental income is also required to be paid by the owner.

Moreover, the property tax calculation can be automatically done with the help of an online calculator available on the MCC website. So, just check out the link, fill in the details, and calculate the property tax.

Mysore City Corporation Property Tax: Exemptions !!

Some structures do face exemption from this tax. These are listed below-

- Agricultural land

- Plots owned by the government or a corporation

- Plots used for educational purposes

- Plots that are used for public worship, charity, and public burial or cremation.

- Properties owned by those who are completely disabled

- Properties owned by the political parties recognized by the Election Commission of India

Frequently Asked Questions About Mysore Property Tax

Question 1: Can I pay property tax for multiple years at once?

Answer: Yes, you can pay the Mysore property tax for multiple years through a single cheque or DD issued in the name of Mysore One.

Question 2: Who do I contact for property tax disputes?

Answer: Mysuru Municipal Corporation can be contacted in case of property tax disputes. You can mail the issue to mccrevenuehelpdesk@gmail.com or contact the Helpline No. 99807-53325 during office hours.

Question 3: What is the PID number? (Unique property identification number

Answer: It is a unique 15-digit property identification number allotted to each property in Mysore. This credential plays a vital role in tax payments

Question 4: How can I find my PID number?

Answer: The PID number is present on the receipt of the last tax payment made by you. If you can't find it, opt for Search by criteria for paying the tax. There you can fill in the property related info and make payment.

Question 5: What are the documents required for property tax payment?

- PID number

- Photo ID of taxpayer

- building completion report

- House tax document

- Khata

- previous year challan of tax payment

- Adhaar card.

NOTE: If you have fractional ownership of the property, then these documents will be collected and submitted by the asset management company.

Question 6: Can I pay property tax in installments?

Answer: You can make partial payments throughout the year and the balance amount can be cleared before the deadline. You need to keep a record of it as the city corporation office currently doesn't support record-keeping of a partial payment system.

Conclusion

So, owning a commercial property like offices, etc. or a residential property like a villa, etc. attracts property tax in Mysore. Here are a few key takeaways to summarize this topic-

- Mysuru Municipal Corporation is responsible for property tax collection. Muda is responsible for designing and developing the layouts.

- The Mysore City Corporation property tax can be paid online through the MCC portal.

- Early payers get a rebate of 5% and late payments are subject to a 2% per month penalty on the amount of property tax Mysore.

It is always suggested to visit the official MCC and Muda websites for the latest info and Mysuru news. Keeping a tab on the latest developments in the city will make you stay updated. So, make property tax payments online and be a responsible citizen.

ADD COMMENT