How about owning a costly asset without paying the complete cost? Yes, this can be done. Just give a chance to the fractional ownership platform and be ready to enjoy a high-value asset. Here, we have summarized fractional ownership meaning, benefits, how it works, etc. So, let's get to understand this interesting concept -

What is Fractional Ownership?

Fractional Ownership is relatively a new business model that promotes the idea of shared ownership. This approach allows multiple individuals to buy a small share of the asset. Each of the investors is liable to pay a fraction of the total value of the high-end asset. This concept aims to make expensive assets more accessible to a range of investors. The asset could be a real estate property, airplane, yacht, artwork, luxury car, rare diamond, etc. So, one doesn't need to pay the entire price yet enjoy the benefits of a high-end asset.

For example, if you have been wishing to buy a holiday villa in Goa but can't afford the high sum. Then, you and some others can together buy shares via fractional ownership. Pay a fraction of the total amount and enjoy the benefits. Each of the investors can use the villa for a designated period of the year.

So, if you have set your heart on a high-value asset but lack the investment required, then adopting this scheme will delight you.

Let's see how this concept works in the case of real estate-

Fractional ownership in real estate is a major trend in the western countries but is now gaining popularity in India too. The real estate property could be a vacation home, commercial property, high-end villa, etc. Multiple owners share the rights and responsibilities of the real estate property. A shared title allows the users to enjoy the asset for a specific period allocated to each. Many properties for sale in Delhi and Mumbai are available with the option of shared ownership. The investors opting for this scheme can get the following benefits-

- Rental income

- Capital Appreciation

- Usage rights

Whereas shared responsibilities include-

- Taxes and insurance

- Fees to the Asset management company

- Repairs and Maintenance

Generally, asset management companies are hired for the upkeep of the property. These companies are pro at keeping real estate assets in the best of condition. These companies charge an annual fee to professionally manage the property, schedules for property usage, staffing requirements, paperwork, etc.

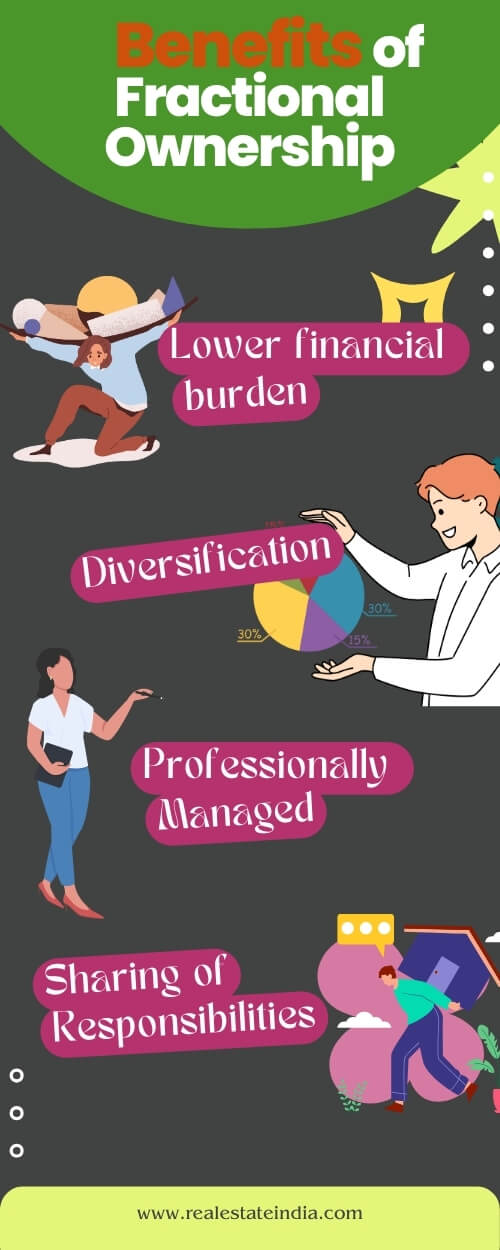

Benefits of Fractional Ownership

The fractional ownership model is a unique way to own a portion of the property without paying its full price. This appealing concept attracts many investors to become part owner. Some of the prime benefits of fractional ownership in India are-

- Lower financial burden

Co-owning a property allows you to split the cost and gain access to the asset. With a small financial commitment, you get ownership of the asset you have been eyeing on.

- Diversification

Diversify your investment portfolio by having fractional stakes in different assets. Investors can have a share in real estate, artwork, and other asset classes. This mitigates the risk and improves profitability.

- Professionally Managed

The co-owners need not get into the hassle of upkeep of the property. The Asset Management Company manages the property. The company takes care of the repairs, staffing, etc. to enable the investors to enjoy the asset.

- Sharing of Responsibilities

The ongoing annual cost of the property is shared among the multiple owners on a pro-rata basis. This uplifts the affordability quotient. The sharing of responsibilities makes the management of the asset viable.

- Scheduling of Usage

Proper guidelines are issued to all the co-owners about how they can use the property. Each investor is allocated a specific period throughout the year to use the asset. This eliminates the chances of conflicts among the co-owners.

This promising real estate investment trend in India is attracting many investors. So, if you are seeking to pay a fraction of total asset value and enjoy its benefits, this option is for you.

How does Fractional Ownership Work?

The model must work systematically to ensure compliance with rules and regulations. The formation of a legal framework is important to avoid disputes among the investors. The owners must thoroughly read the legal documents to make an informed decision.

legal framework of fractional investment-

- A legal entity is formed to buy the asset. Such entities are known as Special Purpose Vehicles (SVP). This entity manages the ownership rights for the investors.

- Investors then buy shares or fractions in the SPV. The entity issues shares or debentures or partnership stakes as per the ownership model. Regulations of SEBI apply in Fractional ownership as there is the involvement of securities.

- The property can be used by a co-owner based on weeks or days allocated.

- A legal agreement is formed among the investors. It defines the title percentage, share in cost, responsibilities, schedule of property usage, etc. The agreement also states the procedure for dispute resolution and exit strategies.

Recently, SEBI has offered a proposal for getting this model under the scheme of MSME and REITs. This would regulate the fractional ownership platform and bring transparency. For more details, check out this link SEBI.

Financial Aspects

The fractional owners must be well aware of the financial aspects before agreeing. A thorough analysis of the risk involved, rights, expected capital appreciation, etc. must be done. The investors should study the below-mentioned components of financial aspects-

-

Initial Cost

-

Purchase price of your share- This is the main component for a co-owner to consider. The initial cost is based on the property or asset value. The share of an investor determines the share in the initial cost.

-

Closing cost- It also includes the closing cost of the deal. This might include the payment of legal fees, transfer taxes, etc. to get the share.

-

Ongoing Costs

- Management fees- Co-owners pay an annual fee to the Asset Management Company. This is paid for the upkeep, staffing, insurance, and other tasks. The fee is well divided among the investors.

- Taxes- The taxes are shared based on percentage. For example, suppose the amount of GST on rental income from a real estate fractional ownership is Rs 100000. And the property has 10 co-owners. Then, each of them will bear the amount of Rs. 10000 for GST.

- Usage fee- This arrangement might involve a usage fee. It is paid each time an investor uses the property.

- Special assessment charge- This arises in case of unforeseen expenses related to the asset. All the owners bear this charge as per their share.

The breakdown of all the above-mentioned costs determines the affordability of fractional investment. So, interested investors must understand all the financial aspects and make the right decision.

Fractional Ownership Properties Comparison

Let's understand the model of fractional real estate in India with the help of a table-

| Property type | Location | Number of owners | Price | Share in property price per owner | Annual Ongoing Cost | Share in Ongoing cost per owner |

|---|---|---|---|---|---|---|

| Commercial real estate | Mumbai | 5 | 100 Cr | 25 cr | 30 lakhs | 6 lakhs |

| Vacation Home | Bangalore* | 8 | 20 Cr | 2.5 Cr | 10 lakhs | 1.25 lakhs |

| Resort | Goa | 10 | 200 Cr | 20 Cr | 50 lakhs | 5 lakhs |

*Note- The co-owners of a vacation home in Bangalore must pay the BBMP property tax. The tax amount will be divided among the 8 owners. The owners can also contact the management company for further information and help.

Comparing Fractional Ownership with other Real Estate Investments

Other similar options for investment in the real estate sector are available. All these differ in terms of flexibility, rights, sage, and other aspects. Let's check them out and make a comparison for a better understanding-

Fractional Ownership Vs Timeshares

Fractional ownership of real estate allows the co-owners to own a fraction of the property. Unlike fractional ownership, timeshare allows the agreement holders to have only access to the property for a period of time. Let's get to know the major differences in both models with the help of a table-

| Feature | Fractional Investment | Timeshares |

| Ownership Rights | Co-owners have title and access | No title, only the right to use it for a period |

| Number of owners | At least 2 | Up to 52 |

| Schedule Availability | 5 weeks or more | 1-2 weeks |

| Equity Share | Co-owners have a share in equity | Holders do not own equity |

| Investment potential | Co-owners share capital appreciation | Timeshare is not for investment purposes |

| Maintenance | Responsibility of co-owners | Holders only pay maintenance fees |

Every form of fractional ownership provides more control, flexibility, and returns to the owners. And timeshare gives you affordability and limited access to use the asset.

Analyze your investment goals before choosing any of them.

Fractional ownership vs full ownership

Assets with fractional investment grant a share in the property ownership. Whereas full ownership grants complete ownership, rights, and control over the property. Let's understand how they differ with the help of a table-

| Feature | Fractional Ownership | Full Ownership |

| Upfront cost | Lower, as the title is shared | Higher, as the owner pays the full price |

| Financial responsibility | Shared among co-owners | Complete responsibility of the single owner |

| Control and access | Partial | Full |

| Investment potential | Proportional share in appreciation | Full appreciation |

| Maintenance | By management company | By the Owner |

The financial condition and priority of the investor decide the option he or she can go with. If you want an affordable option that gives you partial control over the property, then the fractional model is great. But if you want complete ownership and rights, you should go for individual ownership. However, full ownership is an expensive option.

Who should consider Fractional ownership?

Fractional property ownership attracts many investors to pool their funds. It gives title rights to multiple individuals by drawing funds on a pro-rata basis. Candidates invest in the asset together and share the profits and responsibilities as per their share. To make this model work for you, check out our guide to assess if you can be a candidate for this lucrative real estate model.

Ideal candidates for Fractional Ownership

- Investors with limited capital aspiring to own a high-end asset

If sole ownership of a vacation villa or private jet is beyond your pocket, then fractional ownership is for you. You can pay a part amount and co-own it with other candidates.

- Investors wanting diversified investments

Fractional ownership offers to invest in different classes of assets. Investment in real estate, artwork, aviation, etc. diversifies your portfolio. Fractional owners may divide the risk and achieve better returns.

- Investors needing usage for a specific period

Wish to own a holiday home for a getaway and don't need access throughout the year? Then, this scheme is ideal for you. Same way if you need to use a private jet or yacht occasionally, you can own it with less investment.

- Investors are comfortable in Co-owning.

If you don't mind sharing the asset with other candidates, fractional ownership is again a perfect fit. Co-owners not only share the investment part, but ongoing costs, profits, and usage period too.

- Busy bees

Investors having no time to maintain or upkeep the expensive asset can share the responsibilities with others. Fractional investment allows the busy investors to share the responsibilities and the maintenance is done by the property management companies. So, it spares you from the management part.

Though it is an arresting investment option, keep your eyes open. Being informed about several aspects of this model helps you enter a lucrative deal.

Case Study

Here we provide a real-life example of successful fractional ownership.

Miss Divya Seth was working on the model of working from home for 4 months in a year. Due to several disturbances in her home and neighborhood, she could not concentrate. Buying a new house in the area of her choice was very expensive. From a colleague, she got to know about fractional real estate investing in India. She then started her search on the internet.

Her search stopped at a fully furnished home in KHB colony, Bangalore, Karnataka. She co-owns it with a total of 3 owners. The peaceful environment around the house lets her work from home during the 4 months. During her stay, she used to turn a room into a work area with a large desk and some monitors. Adding this professional touch to the house increased her efficiency. The property manager manages the house well. And now she is looking forward to buying other assets with fractional shares.

Challenges and lessons learned

Here is a brief up of a few challenges and the lessons we can learn from them-

1. Limited usage and control

Co-owners may face inconvenience due to the restricted usage period. Getting the time suitable for you can be tricky. This requires coordination with the management company and adjustment among investors.

Lesson learned- Go through the program carefully before investing. The usage guidelines and schedule flexibility must be known in advance. Try to make cordial relations with the co-owners to avoid scheduling conflicts.

2. Unforeseen expenses

Unexpected maintenance expenses or repairs can arise in any investment. This requires a financial contribution from all the co-owners.

Lesson learned- Investors should adopt a reserve fund policy beforehand. This fund helps in meeting special assessment costs and reduces the financial burden.

3. Disagreements among the co-owners

Disagreements about maintenance, upgrades, usage, change of property management company, etc. can arise. Resolving such issues can create conflicts among investors.

Lesson learned

The legal framework for handling the dispute should be strong. Choose a viable type of fractional ownership to minimize conflicts.

No matter what, market research is essential for a successful investment in the real estate market. The property management company must be a pro in handling the issues to make it a success.

Conclusion

The future of this investment option in the Indian real estate market looks bright. Fractional ownership real estate in India attracts many. Fractional owners enjoy a perfect mix of accessibility, diversification, low cost, and appreciation potential. If traditional property ownership is beyond your pockets, go for this option. This enables individuals with lower financial threshold to invest and earn. So, fractionally invest in real estate or aviation or whatever and get the asset of your dreams.

Frequently Asked Questions About Fractional Ownership by People

Q1. What is the minimum investment required for fractional ownership?

It can be as low as Rs 10 lakhs. This applies to small and medium REITs. Earlier it was Rs. 25 lakhs for luxury assets.

Q2. Can I rent out my fractional ownership share?

Depending on the agreement, the owner can rent it to someone else during their designated time. This could be their family members, friends, or others.

Q3. Can I sell my fractional ownership share?

Yes, you can sell your share as per the legal agreement. Some agreements might include a minimum holding period. Do consider it before selling.

Q4. Is fractional ownership the same as REITs?

Real Estate Investment Trust is also a way to invest in property without buying it entirely. However, it differs from the concept of fractional ownership. Unlike fractional ownership arrangements, the owners invest in a REIT that owns and manages the property asset.

Q5. Is Fractional Ownership regulated by SEBI?

Yes, it is regulated by the Securities Exchange Board of India (SEBI).

Q6. Is Fractional Ownership regulated by RERA?

No, it is not regulated by RERA in India. However, the property in question must be RERA-approved.

ADD COMMENT